Crypto market: what else drives Bitcoin's trend besides Fed's interest rates

Crypto-currencies

2025-09-17 14:57:21

The main event of the week — and of today — is the Federal Reserve's policy meeting. As market participants brace for the interest rate decision (scheduled for 18:00 GMT), the dollar is undergoing a correction, with the USDX index rebounding from its two-month low recorded on Tuesday near the 96.55 mark. The dollar is seeing a slight recovery — its sellers appear to be locking in some profits ahead of the key Fed announcement.

However, today's Fed decision may shape the future trajectory not only of the US dollar but also of risk assets, including Bitcoin and other digital currencies.

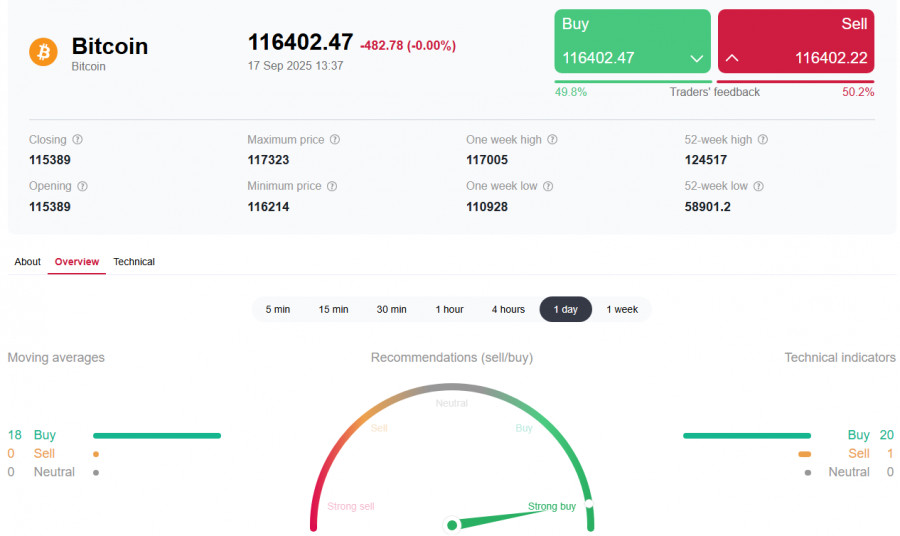

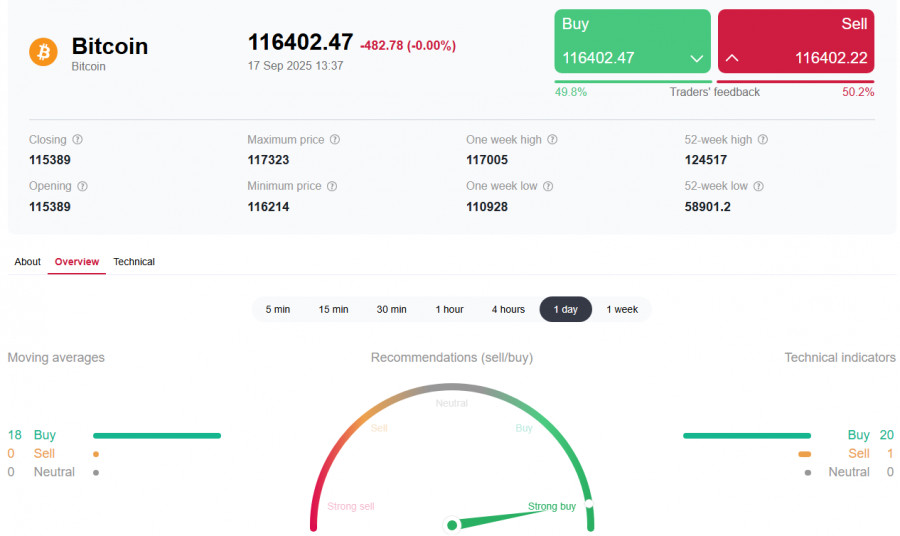

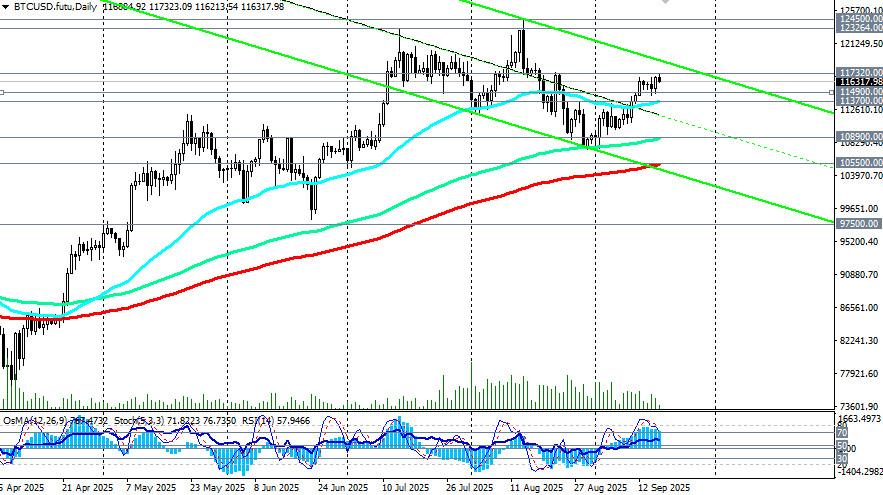

The BTC/USD pair, after reaching a four-week high near 117,320.00 in early European trading, is correcting downward ahead of the Fed's announcement. At the time of this publication, the pair is trading around 116,350.00.

Nevertheless, crypto market experts believe that the immediate market response will depend less on the actual rate cut itself and more on the statements from Fed Chairman Jerome Powell and his guidance regarding future monetary policy steps.

Possible scenarios

- An aggressive rate cut (more than 25 basis points) could spark a rally in risk assets, including cryptocurrencies.

- No significant changes may lead to a price correction.

- A "hawkish" Fed tone (unexpectedly firm) could trigger heightened volatility, especially given currently elevated asset valuations.

In August, amid speculation over the Fed's September decision, Bitcoin hit an all-time high at about 124,500.00, but ended the month down 13% from its peak.

Meanwhile, crypto analysts emphasize that interest rates are not the sole driver of Bitcoin's price trend. Even a rate cut might not lead to price growth if it's rooted in economic weakness, while high inflation and investor caution could continue to dampen risk appetite.

Conclusion

The market is watching the Fed's policy meeting closely, but it's important to remember that a broader mix of economic factors and investor sentiment plays an equally significant role in shaping the future direction of the crypto market.

Overall, our base case remains a further upward move in Bitcoin. A breakout above today's high of 117,320.00 could once again pave the way toward the recent record highs near 124,500.00. Any correction following the Fed's decisions and forecasts is likely to remain limited to the support zone around 115,000.00–113,500.00.

Смотрите также