Trading Recommendations for the Cryptocurrency Market on July 24

Crypto-currencies

2025-07-24 07:20:24

Bitcoin once again attempted to break above $119,000 but failed, retreating today toward the $117,000 level. Ethereum has dropped back below $3,600 and is currently heading toward the $3,500 area, signaling a deeper correction after testing resistance near $3,800.

While traders speculate whether the cryptocurrency market will continue to rise, Bank of New York Mellon and Goldman Sachs announced yesterday the launch of a blockchain-based system that issues "mirror" tokens of money market fund shares. This enables institutional investors to subscribe to and redeem these tokens through BNY's LiquidityDirect platform. The project targets the 7.1 trillion dollar money market industry. Under this initiative, BNY will maintain the official accounting books and settlement records for the participating funds.

Goldman Sachs stated that tokenizing fund shares could enable their use as collateral and pave the way for faster and smoother transfers between markets. The Goldman executive sees this as part of a long-term strategy to modernize market infrastructure, while BNY frames the project as a step toward real-time financial architecture.

It's worth noting that, unlike traditional money markets, which operate during limited hours, tokenized funds offer 24/7 availability and extensive liquidity features due to being hosted on a blockchain network.

The fact that major banks are entering blockchain-based financial markets for the first time is a major development in the world of digital assets. The tokenization trend has already attracted big names from traditional finance. Products like BlackRock's BUIDL and Franklin Templeton's BENJI have a combined asset value exceeding 3 billion dollars, while the total value of real-world assets (RWAs) in the DeFi sector is estimated at around 10.7 billion dollars.

Regarding intraday cryptocurrency strategy, I will continue to focus on any major pullbacks in Bitcoin and Ethereum, aiming to capitalize on the continuation of the medium-term bull market, which remains intact.

Below are the short-term trading strategies and conditions.

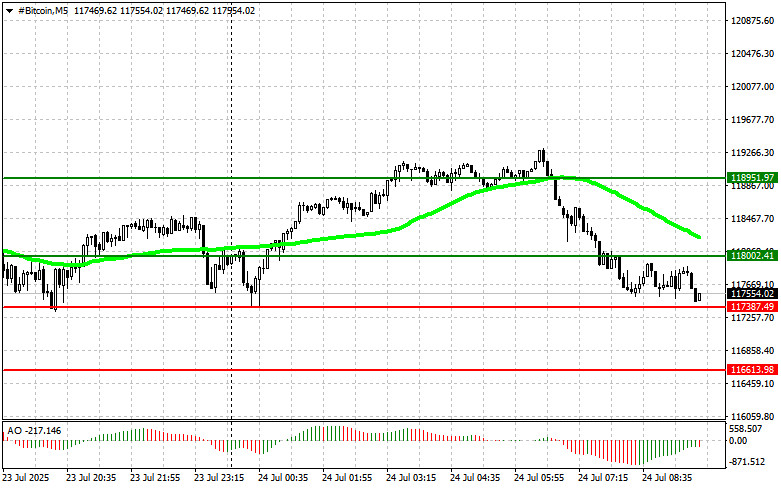

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today at the entry point near $118,000, targeting a rise to $118,900. I intend to exit the long position and sell on a pullback near $118,900. Before entering a breakout buy, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario #2: Alternatively, buying from the lower boundary of $117,300 is possible if there is no market reaction to a breakout, aiming for a return toward $118,000 and $118,900.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today at the entry point around $117,300, targeting a decline toward $116,600. I will exit the short position and buy on a rebound near $116,600. Before entering a breakout sell, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Alternatively, selling from the upper boundary of $118,000 is possible if there is no breakout response, targeting a drop toward $117,300 and $116,600.

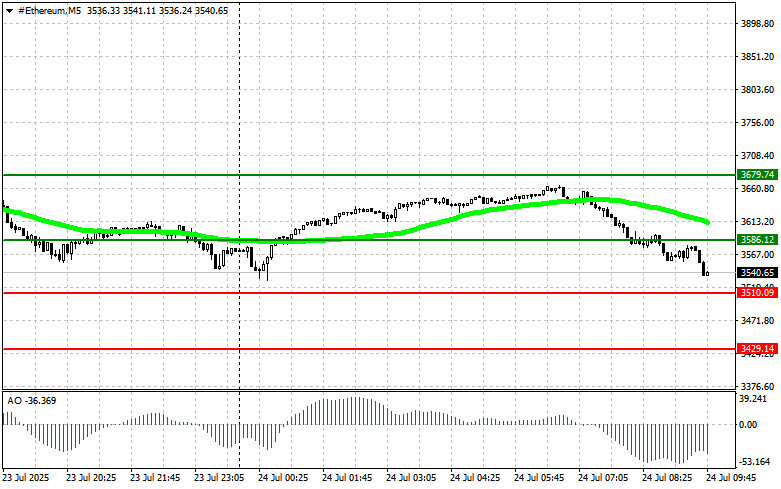

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today at the entry point near $3,586, targeting a rise to $3,679. I will exit the long position and sell on a rebound near $3,679. Before entering a breakout buy, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Alternatively, buying from the lower boundary of $3,510 is possible if there is no market reaction to a breakout, aiming for a move toward $3,586 and $3,679.

Sell Scenario

Scenario #1: I plan to sell Ethereum today at the entry point near $3,510, targeting a decline to $3,429. I will exit the short position and buy on a rebound near $3,429. Before entering a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Alternatively, selling from the upper boundary of $3,586 is possible if there is no market reaction to a breakout, targeting a drop toward $3,510 and $3,429.

Смотрите также