Intraday Strategies for Beginner Traders on November 3

Forecast

2025-11-03 06:44:28

The US dollar has once again strengthened its position against the euro, pound, Japanese yen, and other risk assets. Cautious statements from Federal Reserve representatives on the open question of interest rates in December have led to increased purchases of the US dollar. Traders who previously anticipated a near-guarantee of a cut are now forced to reassess their forecasts, putting additional pressure on risk assets. This situation is compounded by economic data, particularly with their near-total absence. In these conditions, the US dollar acts as a safe haven that traders flock to during periods of uncertainty. The strengthening of the American currency further pressures emerging markets and countries with high debt burdens.

Today, the final business activity index for the manufacturing sector in the Eurozone for October is expected. Given overall uncertainty about economic growth prospects, this indicator could become a catalyst for volatility in the currency market. The industrial sector, acting as a barometer of the economy, is highly responsive to changes in demand and business sentiment. A decline in business activity may signal decreasing orders, reduced production, and ultimately risks of layoffs and investment cuts. Conversely, timid signs of recovery could instill hope and potentially strengthen the euro. However, it is essential not to overestimate the significance of a single index. The market typically looks at a broader context, assessing a range of factors.

Similar manufacturing metrics will be published for the UK. If the index remains below 50 points, the pound may continue the decline observed throughout the past week.

If the data aligns with economists' expectations, it is advisable to implement a Mean Reversion strategy. Conversely, if the data comes in significantly above or below economists' expectations, a Momentum strategy is recommended.

Momentum Strategy (Breakout):

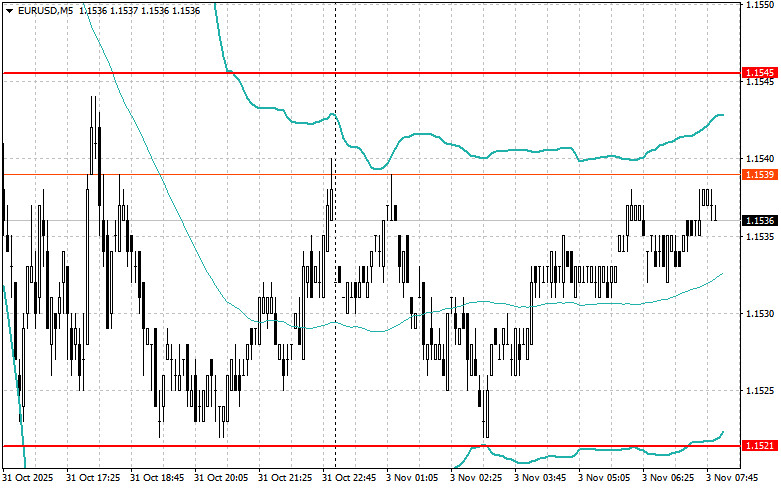

For the EUR/USD Pair

- Buy on a breakout above 1.1550, which could lead to an increase in the euro to around 1.1580 and 1.1610.

- Sell on a breakout below 1.1520, which could result in a drop in the euro to around 1.1489 and 1.1439.

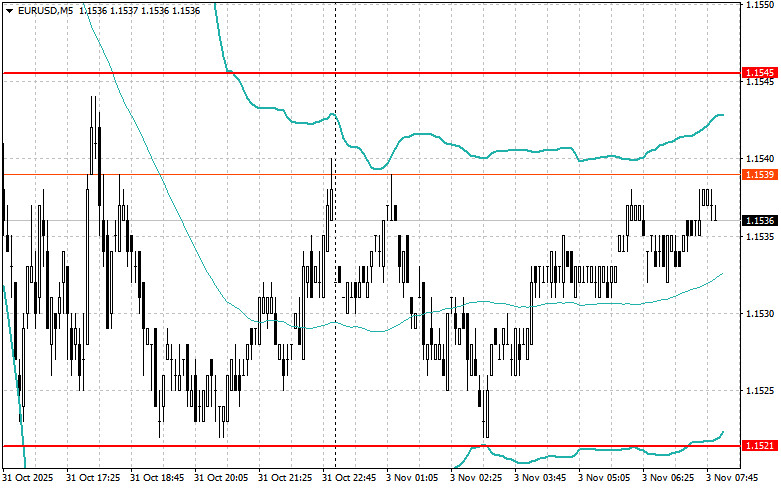

For the GBP/USD Pair

- Buy on a breakout above 1.3161, which could increase the pound to around 1.3188 and 1.3216.

- Sell on a breakout below 1.3127, which could lead to a decrease in the pound to around 1.3095 and 1.3065.

For the USD/JPY Pair

- Buy on a breakout above 154.31, which could lead to an increase in the dollar to around 155.77 and 155.23.

- Sell on a breakout below 153.84, which could lead to a drop in the dollar to around 153.46 and 153.09.

Mean Reversion Strategy (Pullback):

For the EUR/USD Pair

- Sell after a failed breakout above 1.1545, looking for a return below this level.

- Buy after a failed breakout below 1.1521, looking for a return to this level.

For the GBP/USD Pair

- Sell after a failed breakout above 1.3152, looking for a return below this level.

- Buy after a failed breakout below 1.3126, looking for a return to this level.

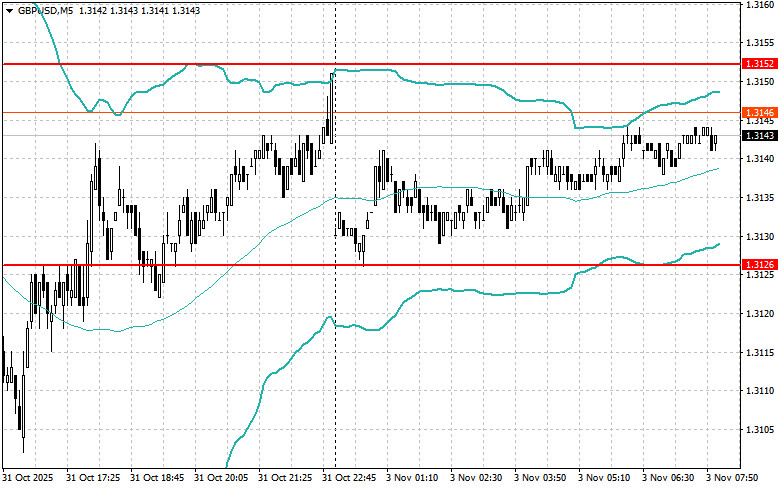

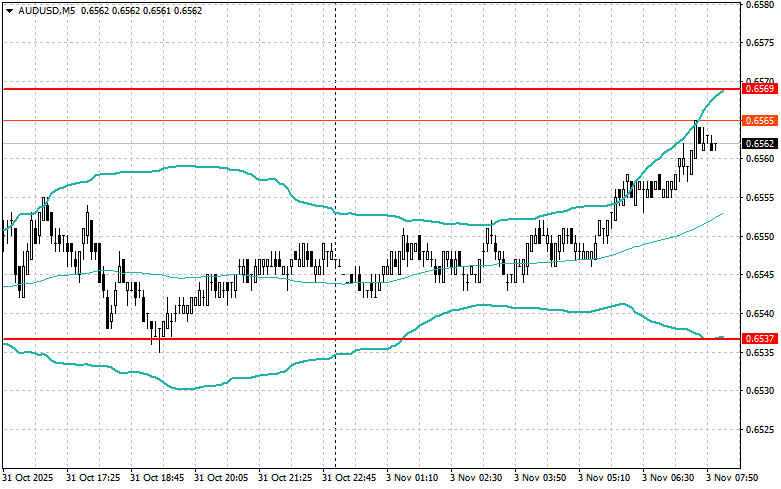

For the AUD/USD Pair

- Sell after a failed breakout above 0.6569, looking for a return below this level.

- Buy after a failed breakout below 0.6537, looking for a return to this level.

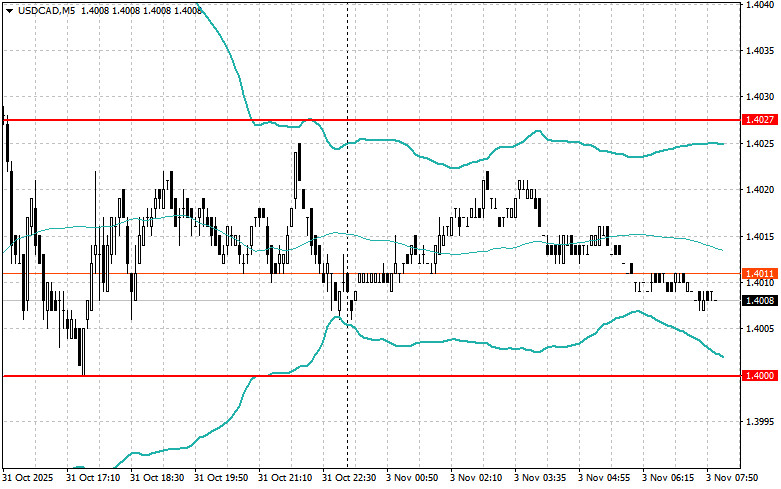

For the USD/CAD Pair

- Sell after a failed breakout above 1.4027, looking for a return below this level.

- Buy after a failed breakout below 1.4000, looking for a return to this level.

Смотрите также