analytics1_1

GBP/USD: Simple Trading Tips for Beginner Traders on November 3. Review of Previous Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on November 3. Review of Previous Forex Trades

Forecast

2025-11-03 06:59:57

Trade Review and Tips for Trading the British Pound

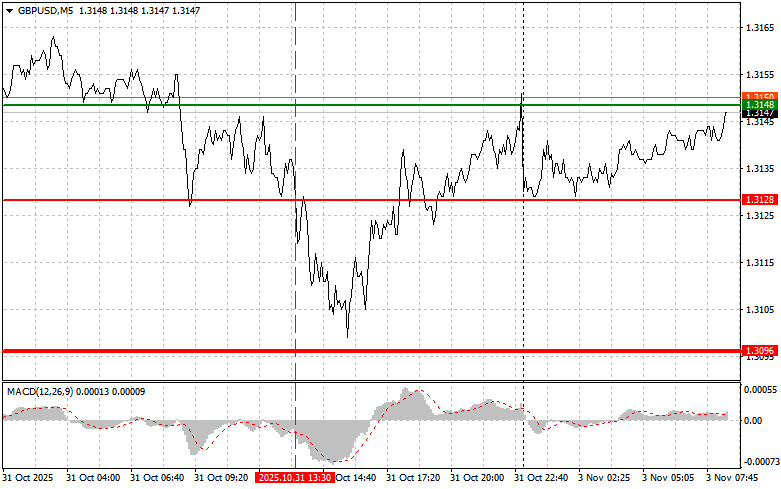

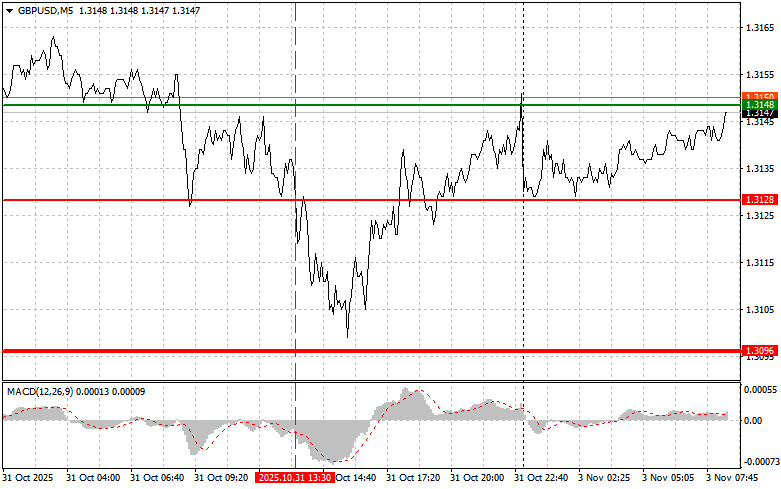

The test of the price at 1.3128 occurred when the MACD indicator had moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound and missed the entire downward movement of the pair. Additionally, I did not get the opportunity to buy on the bounce from 1.3096.

Following quite hawkish statements from Federal Reserve officials, the pound fell. Against the backdrop of a strengthening dollar, driven by expectations of a tight US monetary policy, as well as the UK budget crisis, the British currency is under serious pressure. Investors, fearing a recession in the UK and considering political complexities, prefer to offload the pound, moving into more attractive dollar-denominated assets. Negative economic data from the UK, indicating slowing growth and persistently high inflation, also does not add optimism.

Today, pressure on the pair may continue. This will be sufficient given any weak data regarding the business activity index in the UK manufacturing sector. Negative figures reflecting a decline in manufacturing activity may serve as an additional catalyst for further weakening of the pound. However, it is essential to remember that the market is often irrational and influenced by many factors beyond macroeconomic data. Even bad data may have already been partially priced in, resulting in a muted market reaction. Furthermore, important political victories for Rachel Reeves regarding the advancement of the new national budget may deserve more focus than the incoming data.

For my intraday trading strategy, I will primarily focus on implementing Scenarios 1 and 2.

Buy Scenarios

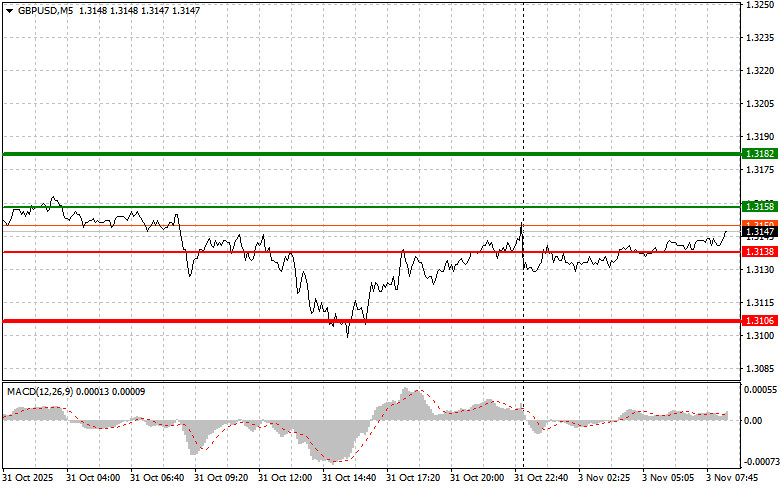

- Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3158 (green line on the chart), targeting a move to 1.3182 (thicker green line on the chart). Near 1.3182, I plan to exit my long positions and initiate shorts in the opposite direction (anticipating a 30-35-pip move back from this level). Growth in the pound can only be expected today within the context of a correction. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

- Scenario No. 2: I also plan to buy the pound today if the price tests 1.3138 twice in a row while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to an upward market reversal. Growth can then be expected towards the opposite levels of 1.3158 and 1.3182.

Sell Scenarios

- Scenario No. 1: I plan to sell the pound today after the 1.3138 level is updated (red line on the chart), which would trigger a quick decline in the pair. The key target for sellers will be the 1.3106 level, where I plan to exit my short positions and open immediate longs in the opposite direction (anticipating a 20-25-pip move back from this level). Sellers of the pound could return to the market at any moment. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

- Scenario No. 2: I also plan to sell the pound today if the price tests 1.3158 twice in a row while the MACD indicator is in the overbought area. This would limit the upward potential of the pair and lead to a market reversal downward. A decrease can then be expected towards opposite levels of 1.3138 and 1.3106.

What the Chart Shows:

- Thin Green Line: Entry price at which one can buy the trading instrument.

- Thick Green Line: Expected price level to set Take Profit or manually secure profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price at which one can sell the trading instrument.

- Thick Red Line: Expected price level to set Take Profit or manually secure profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's crucial to be guided by overbought and oversold areas.

Important: Beginner traders in the Forex market must make trading decisions cautiously. Before the release of crucial fundamental reports, it is best to stay out of the market to avoid sudden price swings. If trading during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, as presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

Смотрите также