analytics1_1

USD/JPY: Simple Trading Tips for Beginners on November 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginners on November 24. Review of Yesterday's Forex Trades

Forecast

2025-11-24 07:03:41

Analysis of Trades and Trading Tips for the Japanese Yen

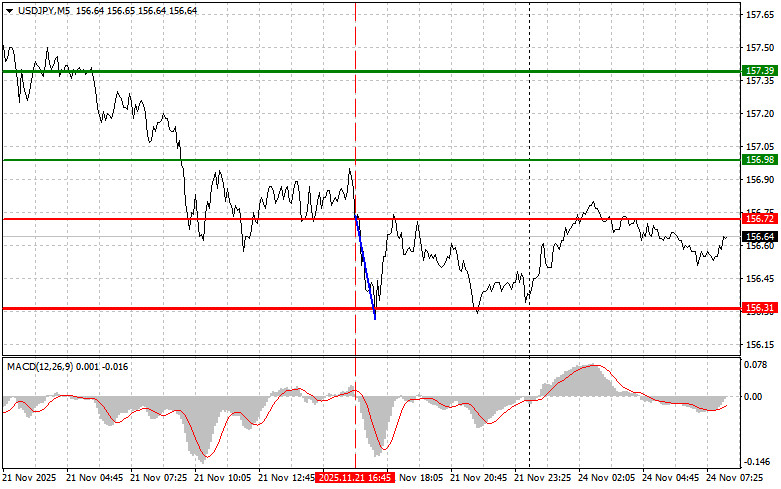

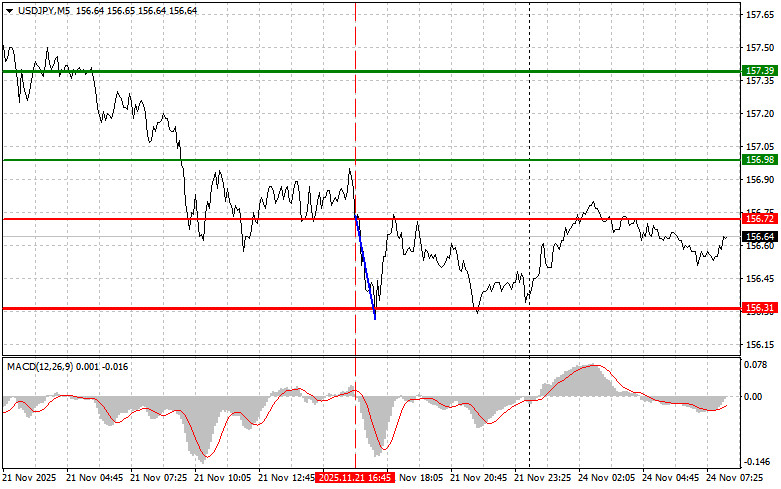

The price test at 156.72 coincided with the MACD indicator just beginning its downward movement from the zero mark, confirming the correct entry point for selling the dollar. As a result, the pair declined to the target level of 156.31.

The decline in the U.S. manufacturing activity index was offset by strengthening in the services sector, providing support for the U.S. currency. However, this was not enough for buyers to return to the market at the end of the week. The significant overbought condition of the dollar against the yen played into the hands of bears, who took the opportunity to lock in profits. Comments from John Williams, President of the Federal Reserve Bank of New York, about his openness to the possibility of lower interest rates at the upcoming December meeting also put pressure on USD/JPY last Friday.

Nevertheless, after such a significant correction in the pair, caution is advised when selling. The yen's weakening trend has not abated, despite statements from Bank of Japan officials last week suggesting that rates might be increased at the December meeting. Until action is taken, it is unlikely that the trend of rising USD/JPY will weaken.

Regarding the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

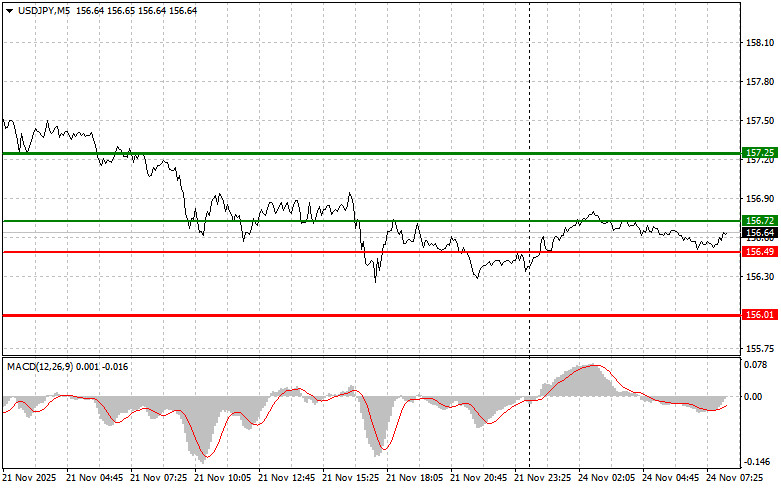

Buying Scenarios

- Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 156.72 (green line on the chart), targeting a move to 157.25 (thicker green line on the chart). At around 157.25, I intend to exit the long positions and open shorts in the opposite direction (expecting a movement of 30-35 pips back from that level). It is best to return to buying the pair during corrections and significant dips in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

- Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 156.49 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward market reversal. An increase can be expected towards the opposite levels of 156.72 and 157.25.

Selling Scenarios

- Scenario #1: I plan to sell USD/JPY today only after it breaks the 156.49 level (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 156.01 level, where I intend to exit shorts and also buy immediately in the opposite direction (expecting a 20-25-pip move back from that level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

- Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 156.72 when the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a market reversal downwards. A decrease can be expected towards the opposite levels of 156.49 and 156.01.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

Смотрите также