Overview of the EUR/USD pair. Weekly preview. Holidays are over, time to get to work

Fundamental analysis

2026-01-05 02:08:58

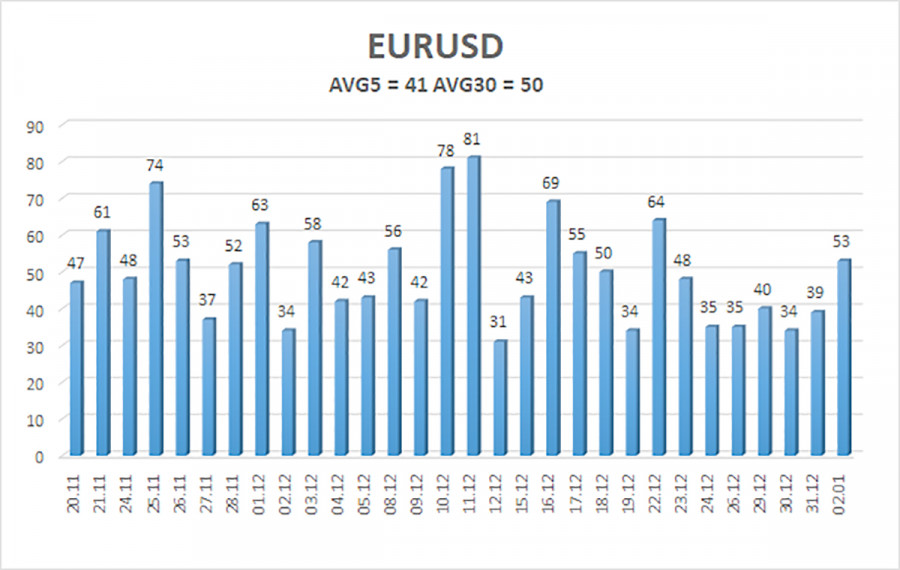

The EUR/USD currency pair traded rather weakly on Friday, since 53 pips of volatility is small even for the euro. Essentially, on Friday, the market continued to rest and celebrate, but normal market functioning should be restored today. That said, this does not mean volatility will immediately jump. Recall that the market traded very reluctantly not only during the Christmas and New Year week. It has traded very sluggishly for several months in a row. However, this is not surprising, as a flat (sideways) market has persisted on the daily timeframe for six months, which explains traders' reluctance to open positions.

We also remind you that in December, there were a considerable number of important news items, events, and releases, yet the EUR/USD pair did not move much and remained flat. Therefore, price movements this week will primarily depend on traders themselves, not on the macroeconomic backdrop. The macroeconomic backdrop is only a trigger for traders. Whether to trade it and to what extent are up to the market.

Nevertheless, one should not ignore macroeconomic events. This week, the European Union will publish reports on inflation, business activity, and unemployment. We do not consider these reports important in the current circumstances, as the market remains entirely focused on U.S. labor-market reports, unemployment, and inflation. Traders currently have no questions for the European Central Bank. Inflation in the EU is steadily around 2%, the economy is growing at a moderate pace, and the ECB has no grounds to change the key rate in the near term. Therefore, the reaction to all EU data published may be extremely weak. Especially since important U.S. data will be released this week, and the market will primarily work through them.

We will discuss U.S. data further in the GBP/USD article, and here we will simply remind traders that, technically speaking, the pair can begin a decline to the 1.1400 level. Our sideways channel is bounded by 1.1400 and 1.1830. Since the pair failed to break 1.1830 over the past two weeks, a drop in the euro and, accordingly, a rise in the dollar may begin, for which no corresponding macroeconomic data are needed. Thus, the dollar may appreciate in the coming weeks even with bad news from across the ocean. And the news itself should not be twisted inside out to somehow explain another illogical market move.

However, there is another possible scenario. If U.S. data disappoint, the market may attempt anew to break above 1.1830. If successful, the flat will end, and we will see the long-awaited resumption of the 2025 uptrend.

The average volatility of the EUR/USD pair over the last five trading days as of January 5 is 41 pips, which is characterized as "low." We expect the pair to move between levels 1.1678 and 1.1760 on Monday. The higher linear regression channel is turning up, but the flat on the daily timeframe persists. The CCI entered the overbought area in early December, but we have already seen a slight pullback. Last week, a bullish divergence formed, indicating a resumption of the uptrend.

Nearest support levels:

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

Nearest resistance levels:

R1 – 1.1780

R2 – 1.1841

Trading recommendations:

The EUR/USD pair has closed below the moving average, but an uptrend remains on all higher timeframes, while the daily timeframe has been flat for the sixth month in a row. The global fundamental backdrop still matters greatly to the market, and it remains negative for the dollar. Over the last six months, the dollar has occasionally shown weak gains, but exclusively within the sideways channel. It lacks a fundamental basis for long-term strengthening. With the price below the moving average, one can consider small short positions on purely technical grounds with targets at 1.1700 and 1.1658. Above the moving average line, long positions remain relevant, with a target of 1.1830 (the upper line of the daily flat), which has already been effectively worked off. Now the flat needs to be finished.

Explanations for illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, the trend is strong;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

- Murrey levels are target levels for moves and corrections;

- Volatility levels (red lines) are the likely price channel in which the pair will spend the next 24 hours based on current volatility indicators;

- The CCI indicator — its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal to the opposite direction is approaching.

Смотрите также