Trading recommendations for the cryptocurrency market on January 20

Crypto-currencies

2026-01-20 07:07:56

Bitcoin fell below $91,000, while Ether trades already around $3,100, which only increases pressure on traders counting on the continuation of the bull market observed since the first days of the new year. Given the geopolitical conflict and the sharp flight from risk assets, be cautious about near-term long positions.

Meanwhile, Anthony Scaramucci, founder of the investment firm SkyBridge Capital, said that a ban on yield-bearing stablecoins in the US undermines the dollar and plays into China's hands, where the digital yuan already yields interest. According to Scaramucci, American banks block such models to avoid competing with stablecoin issuers, making the system less attractive for emerging markets.

Scaramucci emphasized that the United States risks losing its leadership in this area if it does not quickly adapt to new technologies and market needs. Blocking innovative models, such as yield-bearing stablecoins, creates artificial barriers to the development of the digital economy and limits opportunities to attract capital from emerging countries. In turn, the growing popularity of a yield-paying digital yuan could pose a serious challenge to the dollar's dominance.

Note that a similar position was expressed by Coinbase CEO Brian Armstrong, who believes that the Clarity Act, in its current form, will weaken the market and limit users' financial opportunities.

As for the intraday strategy in the crypto market, I will continue to act on large dips in Bitcoin and Ether, while counting on the long-term continuation of the bull market, which has not gone away.

For short-term trading, the strategy and conditions are described below.

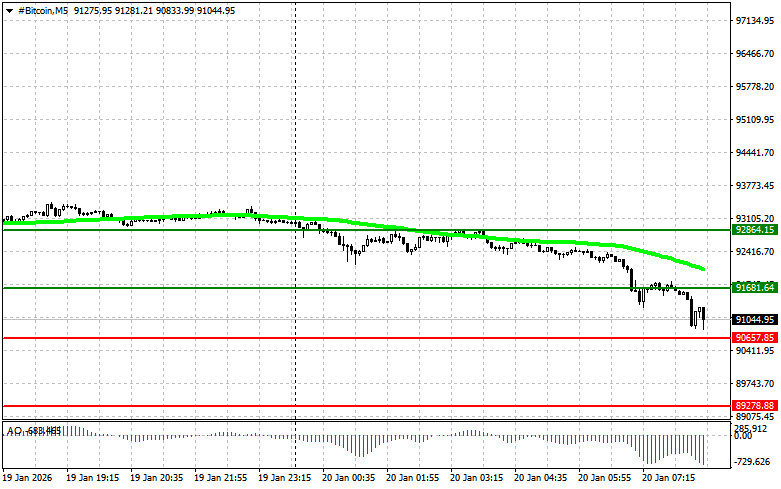

Bitcoin

Scenario for buying

Scenario No. 1: I will buy Bitcoin today if the price reaches an entry around $91,700 with a target to rise to $92,800. Around $92,800, I will exit longs and sell immediately on the bounce. Before buying a breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Bitcoin can be bought from the lower boundary at $90,600 if there is no market reaction to its downside breakout, targeting $91,700 and $92,800.

Scenario for selling

Scenario No. 1: I will sell Bitcoin today if the price reaches an entry around $90,600 with a target down to $89,200. Around $89,200, I will exit shorts and buy immediately on the bounce. Before selling a breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Bitcoin can be sold from the upper boundary at $91,600 if there is no market reaction to its upside breakout, targeting $90,600 and $89,200.

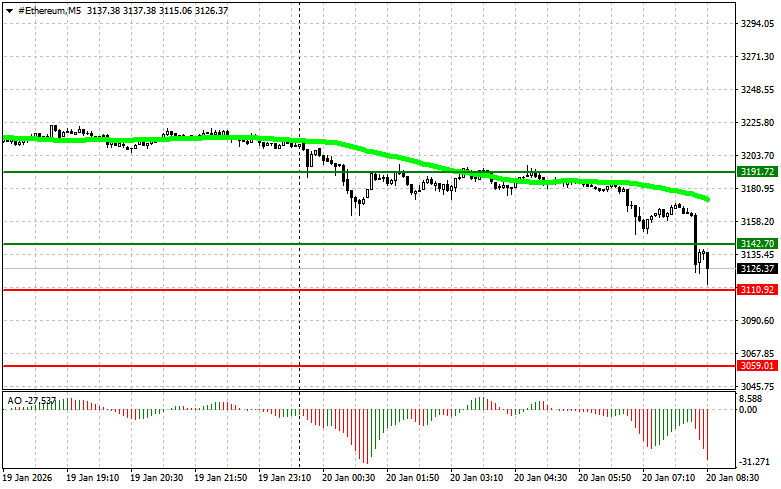

Ethereum

Scenario for buying

Scenario No. 1: I will buy Ether today if the price reaches an entry around $3,142 with a target to rise to $3,191. Around $3,191, I will exit longs and sell immediately on the bounce. Before buying a breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Ether can be bought from the lower boundary at $3,110 if there is no market reaction to its downside breakout, targeting $3,142 and $3,191.

Scenario for selling

Scenario No. 1: I will sell Ether today if the price reaches an entry around $3,110 with a target down to $3,059. Around $3,059, I will exit shorts and buy immediately on the bounce. Before selling a breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Ether can be sold from the upper boundary at $3,142 if there is no market reaction to its upside breakout, targeting $3,110 and $3,059.

Смотрите также