EUR/USD Review. Week Preview. Donald Trump Deals the Dollar a Blow

Fundamental analysis

2026-01-26 02:49:47

The EUR/USD currency pair continued its upward movement on Friday, and over the past week, the dollar has depreciated against the European currency by 250 pips. The pair continues to trade within the sideways channel of 1.1400-1.1830, where it has been for the past 7 months. This week, the pair has shown significant growth, despite relatively positive economic data from across the ocean. However, the market no longer trusts positive American data. Or, to put it better, it does not have confidence in them. Despite the GDP growth and consistently high inflation, the market has clearly been moving away from the dollar in recent days without looking back. Why?

We have repeatedly pointed out that the global fundamental backdrop for the American currency remains poor. The market cannot continuously sell the dollar; otherwise, the euro would already be at $1.50. After all, the dollar remains the currency most often used worldwide for transactions and by central banks for their reserves. However, the process of dedollarization of the global economy continues. This process is not quick, and over the past 12 months, it has been actively supported by Donald Trump.

We still believe the main reason for the dollar's decline is the new administration's policy. It even surprises us when other experts talk about GDP, other currencies, and the "growth of anti-risk sentiment," trying to explain yet another fall of the American currency. Look at the charts from recent years. Best to look at the weekly chart, which provides comprehensive answers to all questions. The first significant drop in the dollar began in October 2022. That was when inflation in the U.S. reached peak levels, and the market began preparing for a softening of the Fed's monetary policy. The next dollar collapse began in January 2025. It is probably unnecessary to remind you of what happened in January 2025 (Donald Trump took office for the second time). Thus, two significant waves of the American currency's decline occurred not without reason.

Therefore, in 2026, we expect what we saw in 2025—a continuing decline of the dollar. The same weekly timeframe clearly shows that after the dollar fell from $1.02 to $1.19, a correction has not occurred. Yes, the pair has been in a flat for seven months, but a flat is one thing, and a correction is another. A three-year upward trend remains, while an 18-year downward trend is coming to an end (or was completed back in 2022).

Next week, the pair will need to break out of the sideways channel of 1.1400-1.1830. At present, it is trading near the upper boundary of this channel. Thus, either the area of 1.1800-1.1830 will be breached, leading to the resumption of the upward trend of 2025, or the pair will bounce back from this area, and the flat will persist.

Can fundamental or macroeconomic events somehow influence the movements of the pair next week? The most important event is the Fed meeting, where there is a 99% probability that the key interest rate will remain unchanged. If there are no changes, then the influence on market sentiment will be minimal. And it should not be assumed that the absence of new easing measures is a growth factor for the dollar. The lack of a rate cut indicates no change in monetary policy, not a reason to buy the U.S. currency.

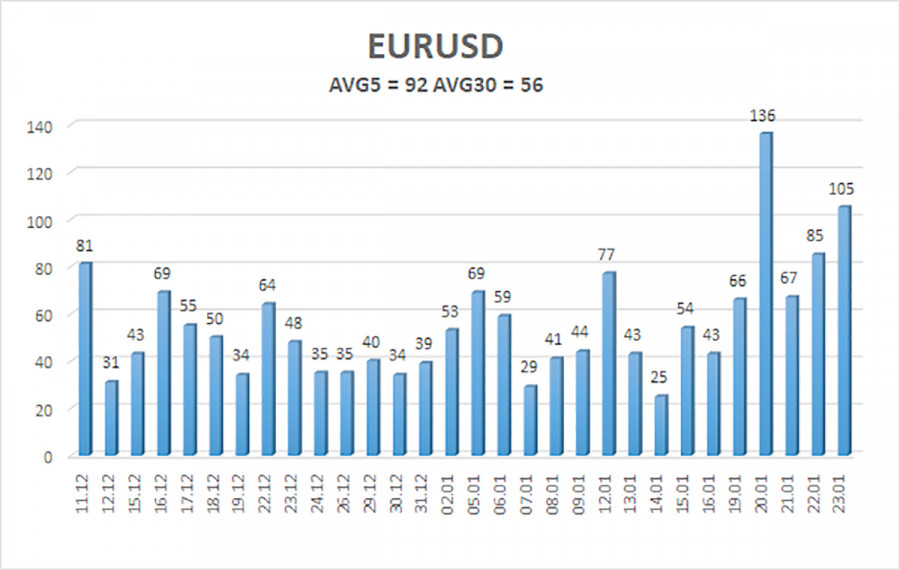

The average volatility of the EUR/USD currency pair over the last five trading days, as of January 26, is 92 pips and is characterized as "average." We expect the pair to trade between 1.1736 and 1.1920 on Monday. The upper channel of linear regression is directed upward, indicating further growth for the euro. The CCI indicator has entered oversold territory this week, indicating a downward pullback that has already completed. We believe that the seven-month flat is approaching its end.

Nearest Support Levels:

S1 – 1.1780

S2 – 1.1719

S3 – 1.1658

Nearest Resistance Levels:

R1 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its upward movement, which has sharply intensified recently. The global fundamental backdrop remains highly significant for the market and extremely negative for the dollar. The pair has spent seven months in a sideways channel; it is likely that the time for a trend resumption is approaching. For long-term growth, the dollar lacks a fundamental basis. With the price positioned below the moving average, small shorts can be considered with targets at 1.1658 and 1.1597 on purely technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1830 (the upper line of the flat on the daily timeframe) and 1.1920.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong;

- The moving average line (settings of 20, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are target levels for movements and corrections;

- Volatility levels (red lines) represent a likely price channel in which the pair will remain for the next day based on current volatility indicators;

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal is approaching.

Смотрите также