GBP/USD Forecast on January 26, 2026

Technical analysis

2026-01-26 10:45:34

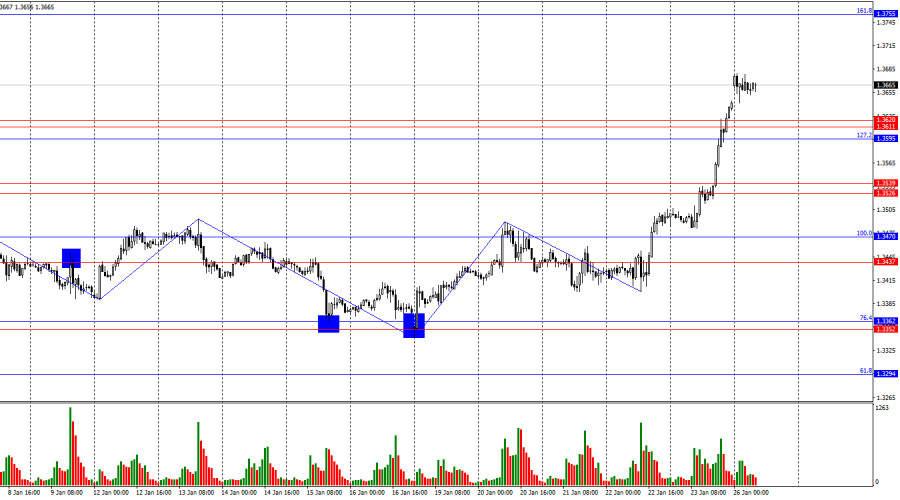

On the hourly chart, the GBP/USD pair continued its upward movement on Friday and finished the day above the resistance level at 1.3611–1.3620. Thus, the growth of the British pound may continue today toward the next corrective level at 161.8% – 1.3755. A consolidation of the pair below the 127.2% Fibonacci level at 1.3595 would favor the U.S. dollar and a certain decline toward the support level 1.3526–1.3539.

The wave picture has shifted to a bullish one. The last completed downward wave failed to break the previous low, while the new upward wave broke the previous high. The fundamental background for the pound has been weak in recent months, but the U.S. backdrop has been even worse. Donald Trump regularly provides support to the bulls, which ensures growth of the British currency.

The fundamental background on Friday offered the bears no hope from the very start of the day. The UK services and manufacturing PMI indices came in above forecasts, and the retail sales report also showed strength. Thus, as early as the morning, the bulls had three solid reasons to continue buying GBP/USD. In the second half of the day, support for the bears could have come from the University of Michigan Consumer Sentiment Index, but traders preferred to focus on geopolitical events, which caused the dollar to fall by more than 200 points in just a few days.

In my opinion, if Donald Trump decides in the near future to conduct military operations in Latin American countries or Iran, this will further worsen the dollar's position. Any new encroachment on the independence of the FOMC could be disastrous for the dollar. In 2026, the U.S. currency is falling despite the Fed's neutral stance. At the same time, traders expect further rate cuts from the Bank of England, and even this factor does not support the bears. As I have repeatedly stated in my articles, I do not believe in the completion of the bullish trend in the British pound.

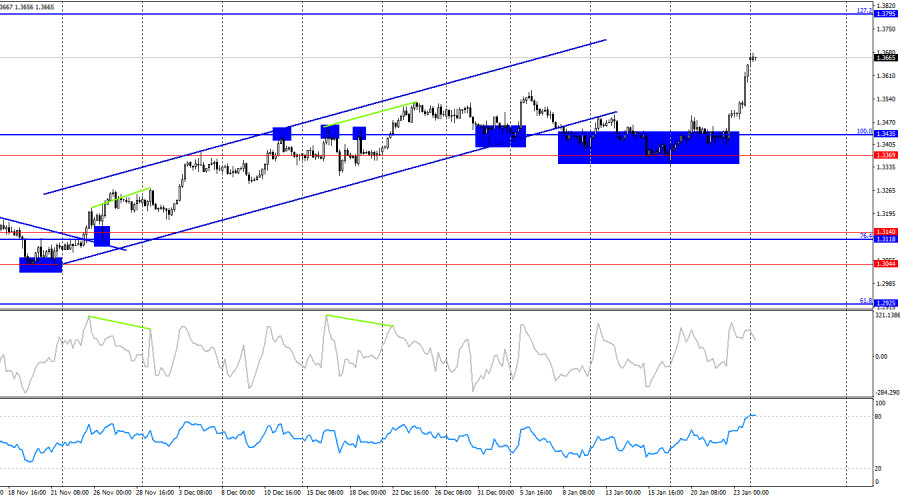

On the 4-hour chart, the pair failed to secure a foothold below the support level of 1.3369–1.3435. The growth process resumed toward the next Fibonacci level at 127.2% – 1.3795, which the bulls are not far from reaching. A rebound from the 1.3795 level would allow traders to expect a small decline. No emerging divergences are observed today.

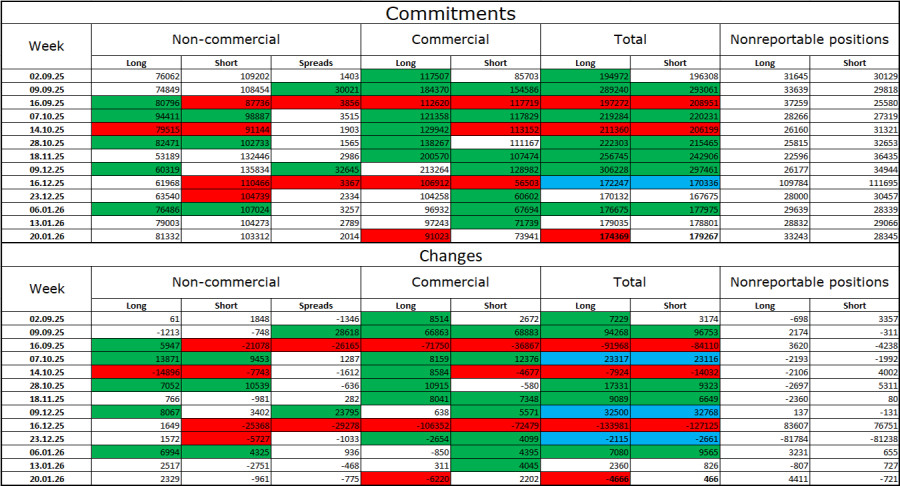

Commitments of Traders (COT) Report:

The sentiment of the non-commercial trader category became more bullish over the latest reporting week. The number of long positions held by speculators increased by 2,329, while the number of short positions decreased by 961. The gap between long and short positions is now effectively 81 thousand versus 103 thousand, and it is rapidly narrowing. Bears have dominated in recent months, but it appears they have exhausted their potential. At the same time, the situation with euro contracts is the opposite. I still do not believe in a bearish trend for the British pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may occasionally see demand in the market, but not in the long term. Donald Trump's policies have led to a sharp decline in the labor market, forcing the Federal Reserve to ease monetary policy in order to curb rising unemployment and stimulate job creation. U.S. military aggression also does not add optimism for dollar bulls.

News Calendar for the U.S. and the UK:

United States – Change in Durable Goods Orders (13:30 UTC).

On January 26, the economic calendar contains one entry that is quite interesting for traders. The impact of the fundamental background on market sentiment on Monday may be felt in the second half of the day.

GBP/USD Forecast and Trading Advice:

Selling the pair is possible today if it consolidates below the 1.3595–1.3620 level on the hourly chart, with a target at 1.3526–1.3539. Buy positions could have been opened after a close above the 1.3437–1.3470 level with targets at 1.3526–1.3539 and 1.3595. Today, buy trades may be kept open with a target of 1.3755.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

Смотрите также