Trading Recommendations for the Cryptocurrency Market on May 30

Crypto-currencies

2025-05-30 07:29:06

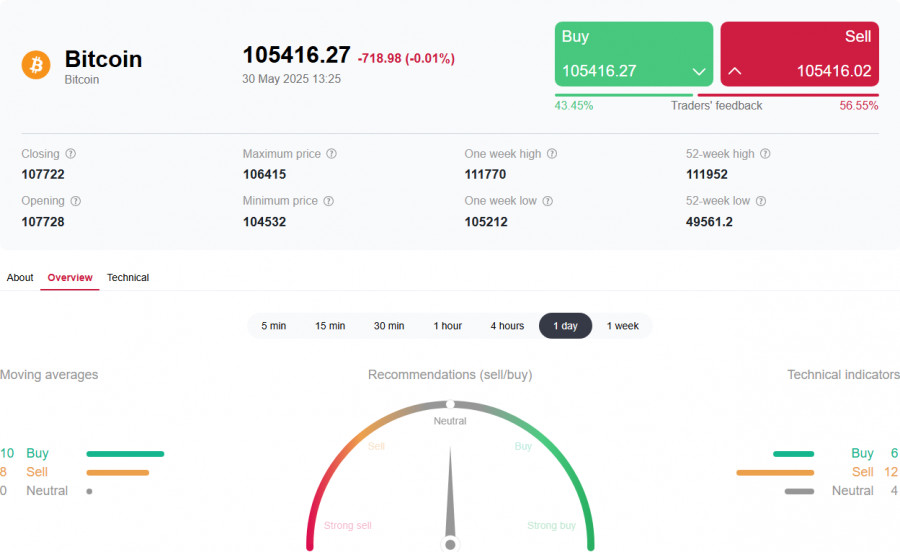

Bitcoin and Ethereum continued their corrections, falling significantly throughout yesterday. The decline extended into today's Asian session, with Bitcoin updating its price to $104,500 and Ethereum testing $2,560.

Thus, it is no surprise that on Thursday, there was a net outflow of $358.6 million from exchange-traded funds (ETFs), ending a 10-day streak of positive flows that had brought in a total of $4.26 billion. This reversal underscores how fragile market optimism can be, highlighting investors' heightened sensitivity to even minor changes in economic indicators and geopolitical events. However, it's important to note that a single day of outflows is not a cause for panic. The ETF market constantly experiences inflows and outflows, and short-term outflows are perfectly normal. Monitoring long-term trends and analyzing the underlying causes of capital movements is much more important.

Possible reasons for the outflow include profit-taking by investors who benefited from the recent market rally and reallocating assets to other classes or sectors that seem more promising under current conditions. Additionally, concerns about upcoming Federal Reserve decisions on interest rates and their potential impact on economic growth could also be a factor.

According to SoSoValue, BlackRock's IBIT was the only spot Bitcoin ETF to report a net inflow of funds, bringing in $125 million. Fidelity's FBTC led the outflows with $166.32 million, followed by Grayscale's GBTC, which saw $107.53 million withdrawn. Net outflows from Ark and 21Shares' ARKB totaled $89.22 million, while Bitwise's BITB saw $70.85 million leave. ETFs from VanEck, Valkyrie, Invesco, and Franklin Templeton also experienced outflows.

Meanwhile, on Thursday, spot Ethereum ETFs listed on U.S. exchanges recorded a net inflow of $91.93 million, marking nine consecutive days of positive flows.

For the intraday strategy, I will continue to focus on large pullbacks in Bitcoin and Ethereum, expecting the ongoing bull market to continue in the medium term.

As for short-term trading, the strategy and conditions are described below.

Bitcoin

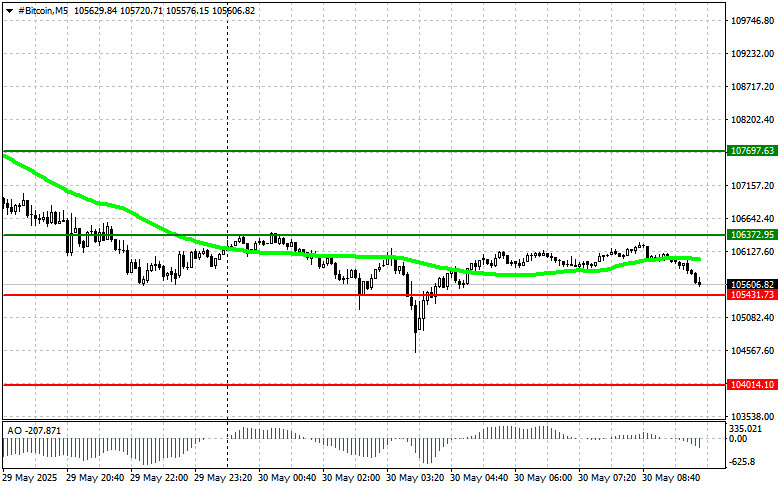

Buy Scenario

Scenario #1: I plan to buy Bitcoin today at the entry point around $106,300, aiming for a rise to $107,600. Around $107,600, I plan to exit the buys and immediately sell on a pullback. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary at $105,300 if there is no market reaction to its breakout, aiming for $106,300 and $107,600.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today at the entry point around $105,400, aiming for a drop to $104,000. Around $104,000, I plan to exit the sales and immediately buy on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary at $106,300 if there is no market reaction to its breakout, aiming for $105,400 and $104,000.

Ethereum

Buy Scenario

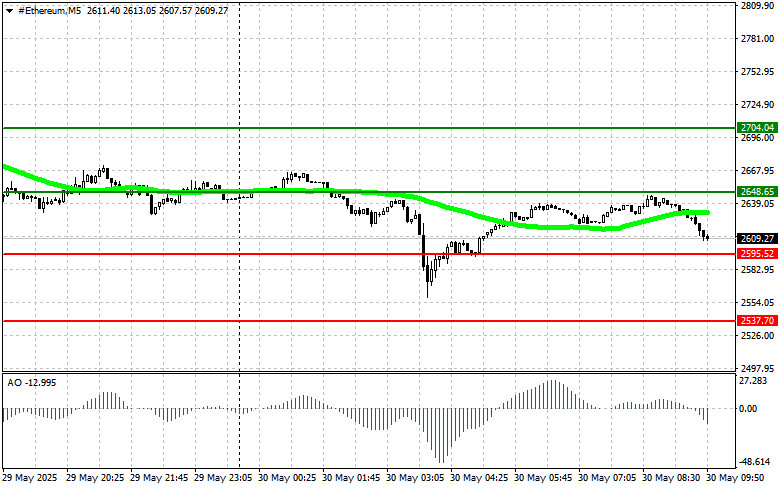

Scenario #1: I plan to buy Ethereum today at the entry point around $2,648, targeting a rise to $2,704. Around $2,704, I plan to exit the buys and immediately sell on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: If the market does not react to Ethereum's breakout, it can also be bought from the lower boundary at $2,595, aiming for $2,648 and $2,704.

Sell Scenario

Scenario #1: I plan to sell Ethereum today at the entry point around $2,595, targeting a drop to $2,537. Around $2,537, I plan to exit the sales and immediately buy on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary at $2,648 if there is no market reaction to its breakout, aiming for $2,595 and $2,537.

Смотрите также