Trading Recommendations for the Cryptocurrency Market on June 11

Crypto-currencies

2025-06-11 07:01:16

Bitcoin is undergoing a correction following yesterday's rapid surge to the $110,500 area, while Ethereum remains vibrant—having gained over 6% yesterday and currently trading at $2,785.

Given such a strong market rally, it's no surprise that long-term holders continue accumulating BTC. According to Glassnode data, the number of coins whales hold has reached a record high of 14.46 million. This metric underscores the confidence of large investors in Bitcoin's future, viewing it not as a speculative asset but as a long-term store of value. This trend signals a shift from short-term volatility to a more stable and sustainable market development—something Bitcoin needs to resume a new bullish trend.

Whales' influence on the crypto market is undeniable. Their large transactions can significantly impact BTC's price. However, their long-term holding strategy signals adherence to a "HODL" paradigm over active trading, indicating trust in Bitcoin's fundamentals and growth potential. The growing number of coins whales hold also suggests that BTC is increasingly seen as a mature asset capable of weathering market swings and delivering long-term gains. This attracts new institutional investors who prioritize stability and reliability in investment decisions.

Overall, the increase in BTC held by whales is a positive signal for the crypto market. It reflects growing trust in Bitcoin as a long-term asset and suggests continued development and market stability. This trend strengthens BTC's position as the crypto industry's leader and confirms its potential as an alternative to traditional financial instruments.

Intraday Strategy Outlook

I will continue to rely on major pullbacks in Bitcoin and Ethereum to enter positions in anticipation of continued medium-term bullish market development.

As for short-term trading, the strategy and conditions are described below.

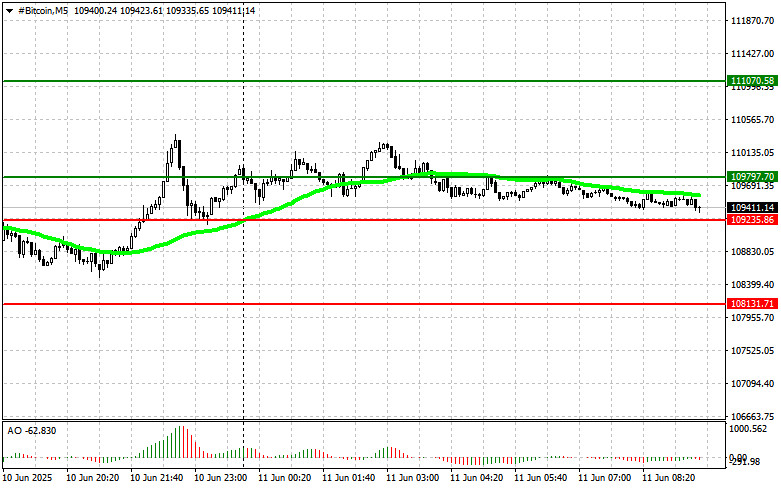

Bitcoin

Buy Scenario

Scenario #1: Buy BTC today upon reaching the entry point near $109,800 with a target of $111,000. Exit long positions near $111,000 and initiate shorts on the pullback.

Condition: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in the positive zone.

Scenario #2: Buy BTC from the lower boundary at $109,200, assuming no market reaction to a breakout below. Look for a reversal back to $109,800 and $111,000.

Sell Scenario

Scenario #1: Sell BTC today upon reaching the entry point near $109,200, targeting a decline to $108,100. Exit shorts at $108,100 and consider buying the rebound.

Condition: The 50-day moving average must be above the current price, and the Awesome Oscillator should be in the negative zone.

Scenario #2: Sell BTC from the upper boundary at $109,800, assuming no market reaction to a breakout above—target levels: $109,200 and $108,100.

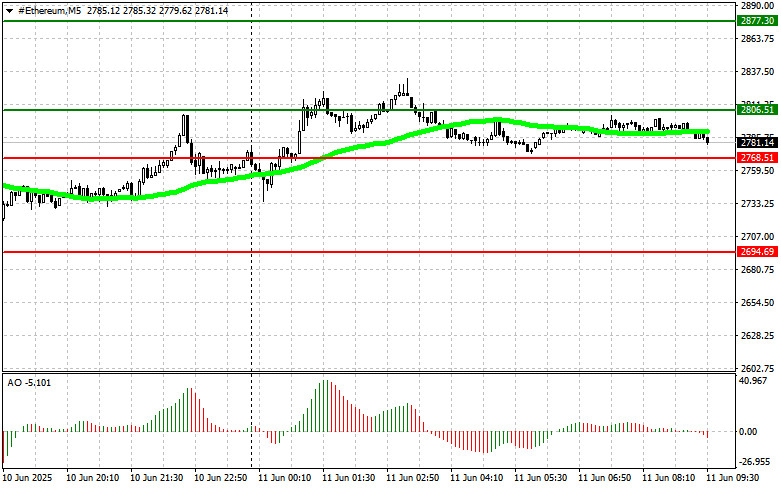

Ethereum

Buy Scenario

Scenario #1: Buy ETH today upon reaching the entry point at $2,806, aiming for a rise to $2,877. Exit at $2,877 and initiate shorts on the pullback.

Condition: The 50-day moving average must be below the current price, and the Awesome Oscillator should be above zero.

Scenario #2: Buy ETH from the lower boundary at $2,768, assuming no downside breakout reaction. Look for upward movement to $2,806 and $2,877.

Sell Scenario

Scenario #1: Sell ETH today upon reaching the entry point at $2,768, targeting a decline to $2,694. Exit shorts at $2,694 and consider long positions on the bounce.

Condition: The 50-day moving average must be above the current price, and the Awesome Oscillator should be below zero.

Scenario #2: Sell ETH from the upper boundary at $2,806, assuming no bullish breakout—target pullbacks to $2,768 and $2,694.

Смотрите также