Trading Recommendations for the Cryptocurrency Market on August 1

Crypto-currencies

2025-08-01 07:34:13

Bitcoin and Ethereum saw a significant decline, ending the month with profit-taking. Despite the correction, July was fairly positive—especially for Ethereum, which gained over 49% in price. Bitcoin rose by 8%.

Meanwhile, Tether published a report revealing that it has issued $20 billion worth of USDT since the beginning of the year, making it one of the largest holders of U.S. government debt. This development has sparked numerous questions and debates in the financial world. On the one hand, the expansion of USDT, backed by the U.S. dollar, theoretically supports stability in the crypto market and facilitates transactions. On the other hand, such a significant increase in Tether's reserves in the form of U.S. Treasuries raises concerns about transparency and the risks associated with concentrating substantial assets in the hands of a single company.

Critics argue that Tether's lack of transparency regarding its reserve structure could pose systemic risks to the cryptocurrency ecosystem. Should Tether face liquidity or solvency issues, it could trigger a chain reaction, negatively affecting the entire digital asset market. Supporters, however, emphasize that Tether undergoes regular audits and publishes reports confirming the backing of USDT. They also argue that the company plays a crucial role in ensuring liquidity and stability in the crypto market, allowing traders and investors to move funds across digital assets efficiently.

Currently, the company holds $127 billion in U.S. Treasuries, and its net profit reached approximately $4.9 billion in the second quarter alone.

As for the intraday crypto trading strategy, I will continue to rely on any major pullbacks in Bitcoin and Ethereum, anticipating that the medium-term bull market remains intact.

The short-term trading strategy and conditions are outlined below.

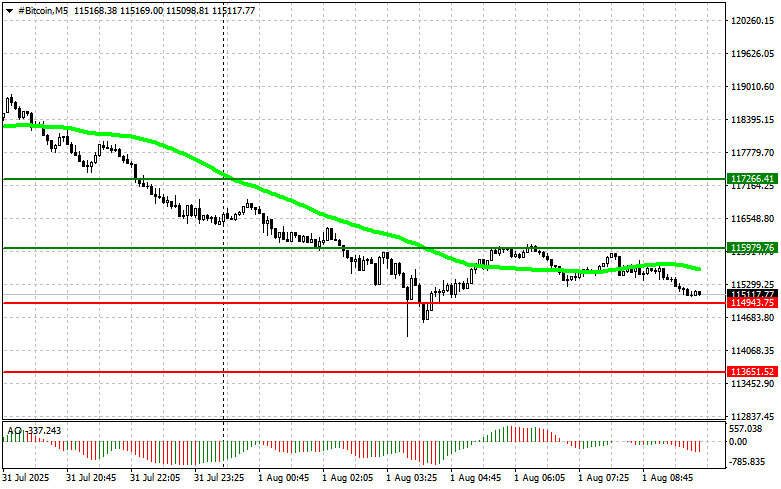

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today at the entry point near $115,900, targeting a rise toward $117,200. Around $117,200, I will exit long positions and open shorts on a bounce. Before buying on a breakout, make sure the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Bitcoin can also be bought from the lower boundary of $114,900 if there is no market reaction to a breakout below, aiming for a rebound toward $115,900 and $117,200.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today at the entry point near $114,900, targeting a decline toward $113,600. Around $113,600, I will exit short positions and open longs on a bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Bitcoin can also be sold from the upper boundary of $115,900 if there is no market reaction to a breakout above, aiming for a return toward $114,900 and $113,600.

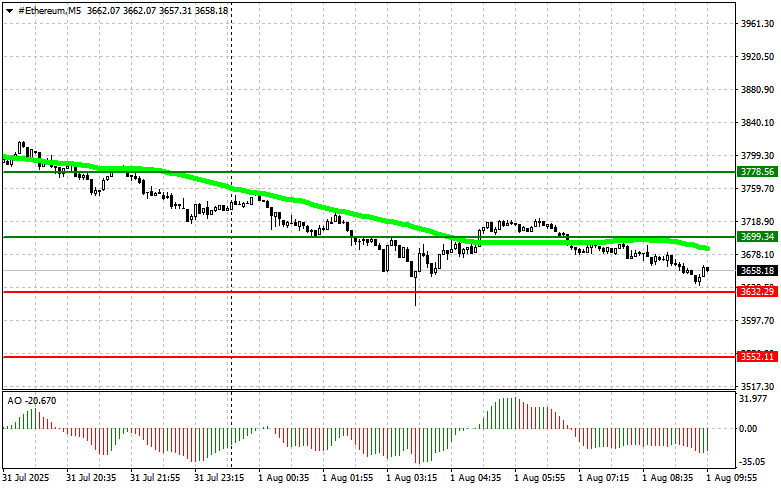

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today at the entry point near $3,881, targeting a rise toward $3,950. Around $3,950, I will exit long positions and open shorts on a bounce. Before buying on a breakout, make sure the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Ethereum can also be bought from the lower boundary of $3,841 if there is no market reaction to a breakout below, aiming for a return toward $3,881 and $3,950.

Sell Scenario

Scenario #1: I plan to sell Ethereum today at the entry point near $3,841, targeting a decline toward $3,775. Around $3,775, I will exit short positions and open longs on a bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Ethereum can also be sold from the upper boundary of $3,881 if there is no market reaction to a breakout above, aiming for a return toward $3,841 and $3,775.

Смотрите также