Trading Recommendations for the Cryptocurrency Market on September 15

Crypto-currencies

2025-09-15 07:04:52

Demand for Bitcoin remains at a reasonably high level. Given that the weekend passed with no major corrections and that we have a Fed meeting and potential rate cuts ahead this week, the stage is set for further crypto market recovery and new local highs.

Data from CryptoQuat support this theory. According to their report, whales continue to buy ETH and BTC actively. In fact, wallet balances holding 10,000-100,000 ETH have hit a record high. CryptoQuat notes that ETH is currently in one of its strongest cycles: institutional demand, staking, and on-chain activity are all approaching historic highs.

The growth in whale balances—especially among those holding large amounts of Ethereum and BTC—indicates strong confidence in the long-term prospects of these assets. Institutional interest, backed by ETH staking opportunities, provides a steady inflow of capital and reduces volatility. Network activity, encompassing both DeFi and NFT segments, highlights Ethereum's utility and ongoing demand.

However, even the most positive signals do not guarantee a smooth future. The crypto market remains susceptible to regulatory changes, macroeconomic factors, and sudden technological breakthroughs. While the CryptoQuat data strengthens the bullish outlook, pointing to large player consolidation and robust market growth, prudent skepticism and continuous market monitoring remain essential to protect against risks and maximize gains.

For intraday crypto trading, I'll continue to look for major dips in Bitcoin and Ethereum as opportunities for bullish medium-term plays, as the bull trend remains intact. Short-term trading strategies and conditions are outlined below.

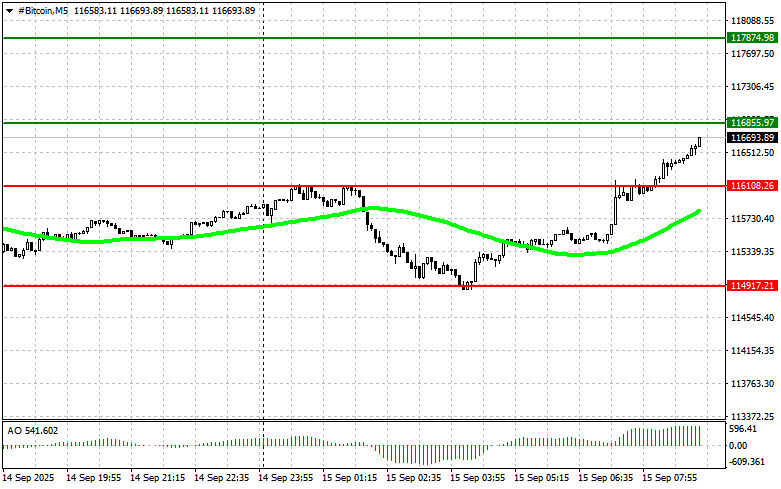

Bitcoin

Buy Scenario

- Scenario #1: Plan to buy Bitcoin today at an entry point around $116,800, targeting a rise to $117,800. Around $117,800, I'll exit longs and sell on the bounce. Before entering a breakout long, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Bitcoin from the lower boundary at $116,100 if there is no market reaction to a breakdown, aiming for a reversal back up to $116,800 and $117,800.

Sell Scenario

- Scenario #1: Plan to sell Bitcoin at $116,100, targeting a fall to $114,900. Exit shorts and buy on the bounce at $114,900. Before a breakout short, confirm the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Bitcoin from the upper boundary at $116,800 if there is no market reaction to a breakout, aiming for a move back down to $116,100 and $114,900.

Ethereum

Buy Scenario

- Scenario #1: Plan to buy Ethereum today at an entry around $4,680, targeting a rise to $4,745. I'll exit longs and sell on the bounce at $4,745. Before a breakout long, confirm the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Ethereum from the lower boundary at $4,636 if there's no market reaction to a breakdown, targeting reversals back up to $4,680 and $4,745.

Sell Scenario

- Scenario #1: Plan to sell Ethereum at $4,636, targeting a drop to $4,582. Exit shorts and buy on the bounce at $4,582. Before a breakout short, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Ethereum from the upper boundary at $4,680 if there's no follow-through on a breakout, targeting a reversal back down to $4,636 and $4,582.

Смотрите также