Cryptocurrency Market Trading Recommendations for October 13

Crypto-currencies

2025-10-13 06:51:53

Bitcoin plummeted to $101,000, later stabilizing near $112,000. It is currently trading at $115,000, opening a real opportunity for recovery above $116,000. Ethereum has reclaimed nearly 80% of its losses from the end of last week.

According to data, the crypto market crash led to a record $19 billion in liquidated long positions. Many market participants connect the sudden drop in Bitcoin and altcoins to potential new aggressive tariffs from U.S. President Donald Trump aimed at China. A combination of factors—leverage, automatic sell triggers, and lack of liquidity during off-market hours—contributed to the rapid reduction in positions.

This event marks the largest single-day sell-off in the market's history. Now, traders are trying to identify which major player was flushed out.

Data from CoinGlass confirmed more than 1.6 million traders were liquidated. So far, no major whale investor has officially admitted to being wiped out.

In the cryptocurrency market, margin calls do not work the same way as on traditional exchanges: when collateral falls, algorithms sell automatically. As a result, a system designed to run 24/7 can work against the market, and sharp volatility leads to rapid acceleration in losses. Since Trump made his announcement during a U.S. holiday weekend, there was a lack of active participants in the market, intensifying the crash.

These issues became especially apparent on the Hyperliquid exchange. While its trading volume is smaller than Binance, Hyperliquid's USD trading volume hit $10 billion during the panic.

Many have also blamed the crash on the automatic deleveraging (ADL) system, which liquidates severely leveraged positions automatically when liquidation volumes exceed what available insurance can cover. Exchanges use ADL as a safeguard during extreme volatility to protect the broader system from cascading losses.

In any case, the market is now partially recovering from the sell-off, and soon, most will have forgotten about it.

As for intraday strategy in the crypto market, I will continue to respond to major dips in Bitcoin and Ethereum, expecting the medium-term bull market—which remains intact—to reassert itself.

Below are the conditions and strategies for short-term trading.

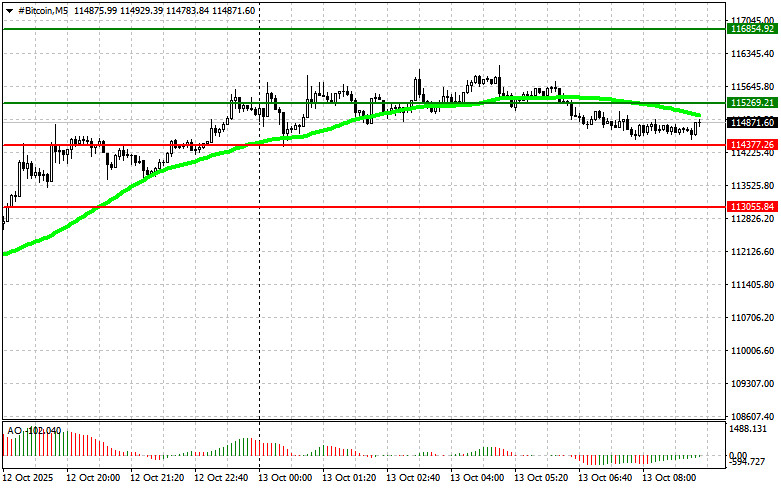

Bitcoin

Buy Scenario

- Scenario 1: I plan to buy Bitcoin today upon reaching the entry point near $115,300, with a target of rising to $116,800. Around $116,800, I will close the long position and immediately sell on the expected pullback.

- Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: Buying is also possible from the lower boundary of $114,300, provided there is no breakout and a return toward $115,300 and $116,800.

Sell Scenario

- Scenario 1: I plan to sell Bitcoin today at the $114,300 entry point, targeting a fall to $113,000. Around $113,000, I will exit shorts and buy on rebound.

- Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: I can also sell from the upper boundary at $115,300 if there is no follow-through after a breakout, targeting a return to $114,300 and then $113,000.

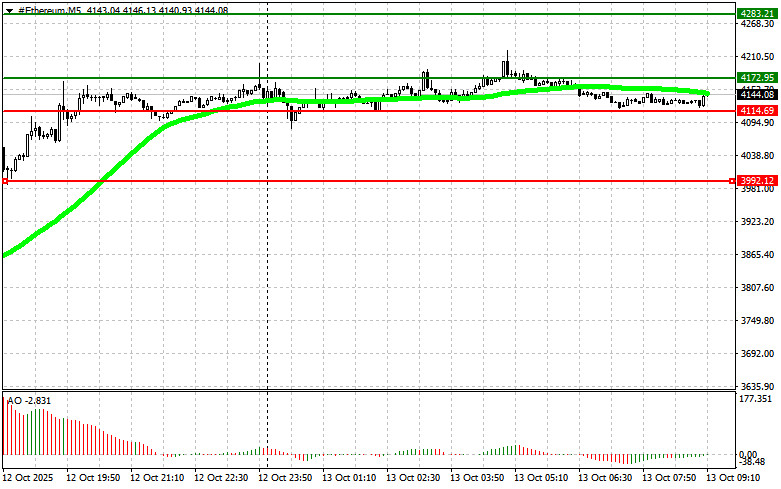

Ethereum

Buy Scenario

- Scenario 1: I will buy Ethereum today upon reaching the entry point near $4172, with a target of rising to $4283. Around $4283, I will take profit and open short positions on the pullback.

- Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

- Scenario 2: Alternatively, I will buy from the lower boundary of $4114 if no breakout occurs, with a rebound back toward $4172 and $4283.

Sell Scenario

- Scenario 1: I plan to sell Ethereum today after reaching the $4114 entry point, targeting a decline to $3992. Around $3992, I will exit sales and open long positions on the rebound.

- Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: I can also sell from the upper boundary at $4172 if no follow-through occurs after a breakout, with expected return to $4114 and $3992.

Смотрите также