Trading Recommendations for the Cryptocurrency Market on November 20

Crypto-currencies

2025-11-20 06:51:25

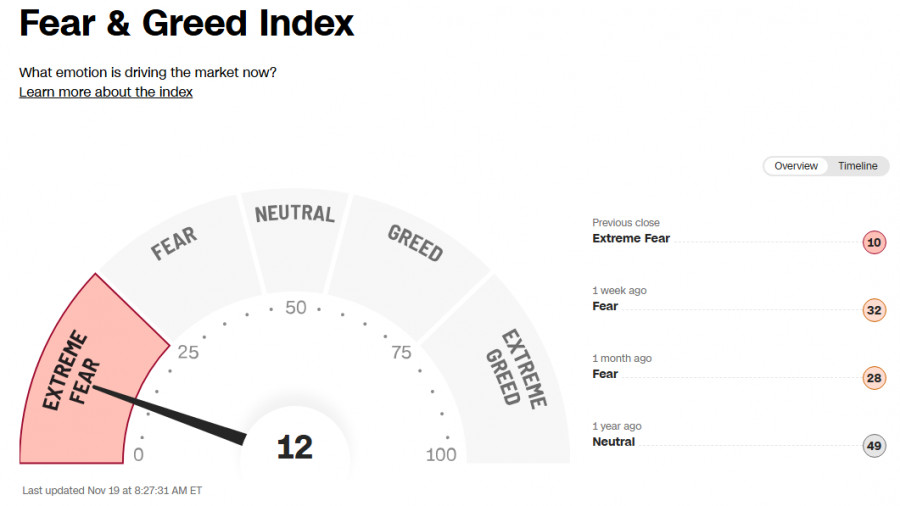

Bitcoin recovered after hitting a new monthly low of around $88,700 yesterday. Ethereum is also attempting to establish itself above the $3,000 mark.

The sharp rise in the U.S. stock market pulled the cryptocurrency market along with it. The focus yesterday shifted to Nvidia Corp.'s earnings report and forecast. After the release of strong figures, traders revised their positions, easing concerns about a potential bubble in the artificial intelligence industry that had recently stirred markets worldwide.

As the flagship of digital assets, Bitcoin rose, pulling altcoins along with it. Investors felt a renewed sense of confidence, and risk appetite significantly increased. However, caution remains in the market. Some experts warn against excessive optimism, pointing out that one successful report does not guarantee sustained growth, a statement that is hard to dispute.

In the coming days, attention will focus on additional economic data and statements from Federal Reserve officials. These factors could alter the current market dynamics and determine its further direction. It's important to remember that, despite their integration with traditional finance, cryptocurrencies remain volatile assets.

Regarding the intraday strategy, I will continue to base my actions on significant dips in Bitcoin and Ethereum, with the expectation of a bullish market developing in the medium term.

As for short-term trading, the strategy and conditions are described below.

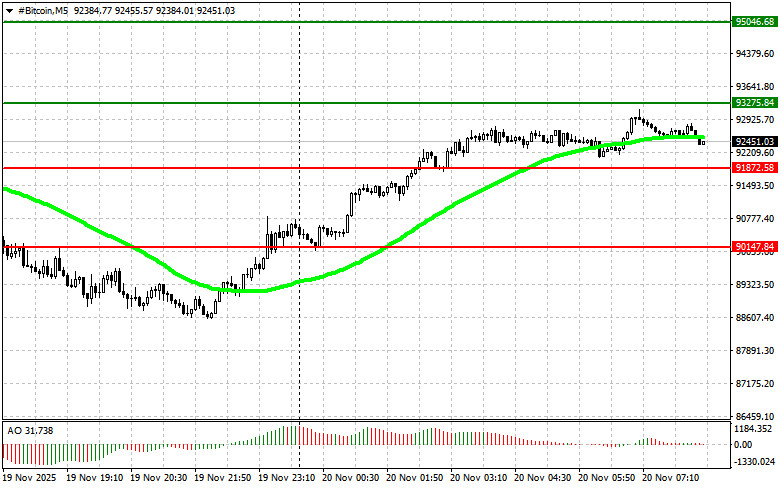

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today upon reaching an entry point around $93,200, targeting a move to $95,000. At $95,000, I will exit my buys and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome indicator is in the zone above zero.

- Scenario #2: Buying Bitcoin can also occur from the lower boundary at $91,800, provided there is no market reaction to its breakdown back to $93,200 and $95,000.

Sell Scenario

- Scenario #1: I will sell Bitcoin today upon reaching an entry point around $91,800, targeting a drop to $90,100. At $90,100, I will exit my sales and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

- Scenario #2: Selling Bitcoin can occur at the upper boundary of $93,200, provided there is no market reaction to its breakdown back to $91,800 and $90,100.

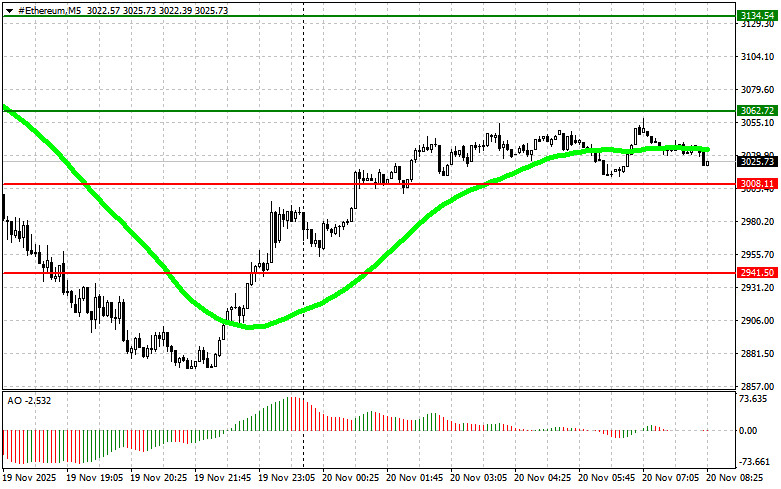

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today upon reaching an entry point around $3,062, targeting a move to $3,134. At $3,134, I will exit my buys and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome indicator is in the zone above zero.

- Scenario #2: Buying Ethereum can also occur from the lower boundary at $3,008, provided there is no market reaction to its breakdown back to $3,062 and $3,134.

Sell Scenario

- Scenario #1: I will sell Ethereum today upon reaching an entry point around $3,008, targeting a drop to $2,941. At $2,941, I will exit my sales and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

- Scenario #2: Selling Ethereum can occur at the upper boundary of $3,062, provided there is no market reaction to its breakdown back to $3,008 and $2,941.

Смотрите также