Fed policymaker Neil Kashkari sees no potential in cryptocurrencies

Crypto-currencies

2026-01-15 08:17:15

In yesterday's remarks, President of the Federal Reserve Bank of Minneapolis Neil Kashkari expressed optimism about the outlook for the US economy, saying he expects continued growth and lower inflation. He also touched on cryptocurrencies, calling them essentially useless for consumers.

"My forecast for the US economy assumes fairly good growth ahead," Kashkari said during a virtual event. "I think inflation is coming down. The question is whether it will be around two-and-a-half percent by year-end."

The official emphasized that most cryptocurrencies are not backed by real assets and are subject to high volatility, making them a risky investment instrument. He also noted problems related to the use of cryptocurrencies in illicit activities.

Expanding on his point, Kashkari added that regulators should tighten oversight of the crypto market and develop clear rules to protect investors and prevent abuse. He also urged consumers to exercise caution and not invest in cryptocurrencies if they do not understand the risks associated with these assets.

His remarks drew mixed reactions in the crypto community but underscore the importance of debating regulation and the potential risks of digital currencies.

Trading recommendations

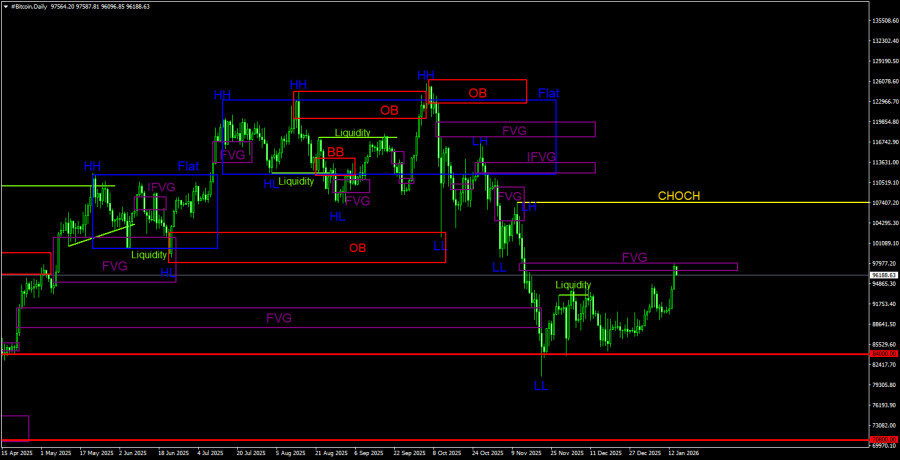

Bitcoin

Buyers are currently targeting a return to $97,300, which opens a direct path to $99,400 and then to $102,400. The farthest target is the high near $105,300; breaking that would signal attempts to return to a bull market. In case of a decline, buyers are expected at $95,600. A move back below that area could quickly push BTC toward $93,600. The farthest downside target is $92,100.

Ethereum

A clear hold above $3,372 opens a direct path to $3,505. The farthest target is the high near $3,664; surpassing that would indicate strengthening bullish sentiment and renewed buyer interest. In case of a decline, buyers are expected at $3,297. A move back below that area could quickly push ETH toward $3,229. The farthest downside target is $3,154.

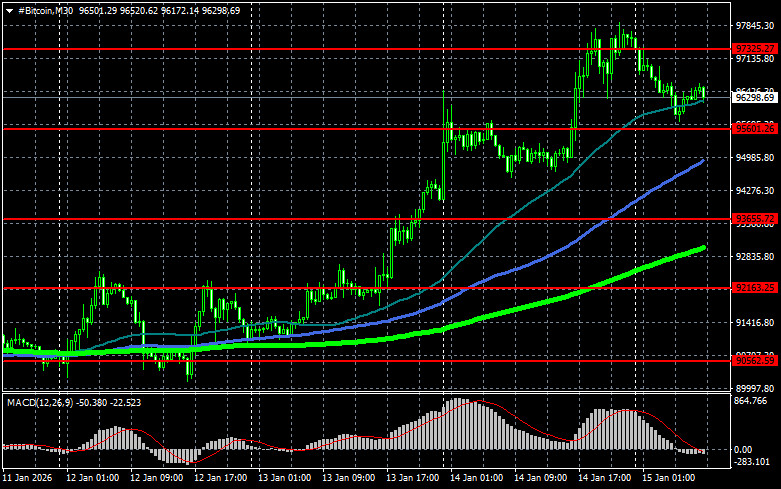

Chart indicators

- Red indicators represent support and resistance levels, where a slowdown or active price increase is expected.

- Green represents the 50-day moving average.

- Blue indicates the 100-day moving average.

- Light green signifies the 200-day moving average.

Crossovers or tests of the moving averages usually halt or set the market's momentum.

Смотрите также