Recommendations for Trading in the Cryptocurrency Market on December 1

Crypto-currencies

2025-12-01 06:36:35

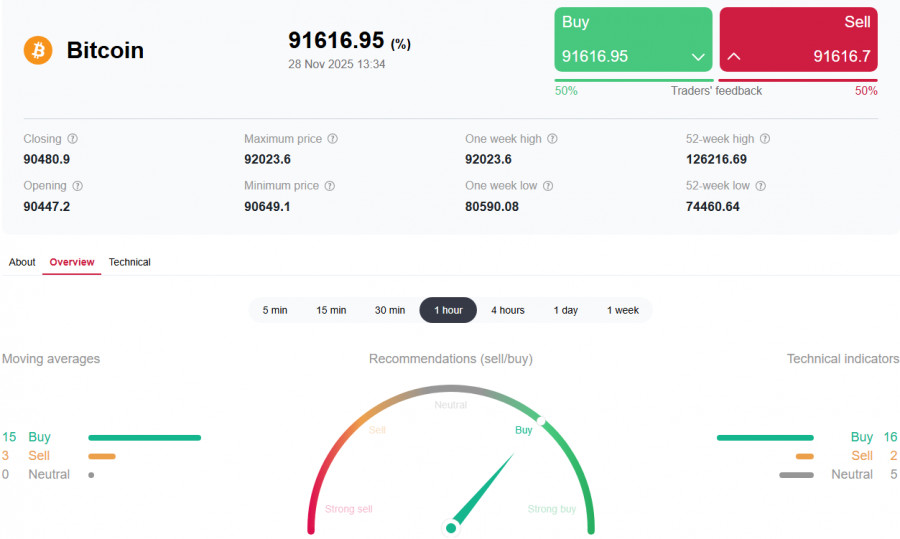

Traders barely had a moment to catch their breath after Bitcoin hit $93,000 last week when active selling in the cryptocurrency market pushed the world's first cryptocurrency to around $85,500 at the opening of the Asian session. It seems that this is still far from the end of the bear market. Ethereum has also dropped below $3,000 and is currently trading around $2,820.

Meanwhile, according to Farside data, outflows from spot BTC ETFs stopped last week, while inflows into spot ETH ETFs were recorded. Additionally, there have been continued inflows into spot SOL ETFs.

After a period of relative stagnation and outflows from crypto funds, this could signal a shift in investor sentiment. However, today's significant sell-off in the cryptocurrency market completely negated any bullish sentiment. It is evident that one successful period does not guarantee a long-term trend. It is essential to consider factors that affect investor decisions, such as the macroeconomic environment, regulatory changes, and overall risk perceptions in financial markets. The inflows into ETH and SOL ETFs, in particular, may indicate increased interest in alternative cryptocurrencies and their technological capabilities, in contrast to the more conservative BTC.

Regarding the intraday strategy for the cryptocurrency market, I will continue to act on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of the mid-term bullish market, which has not gone away.

For short-term trading, the strategy and conditions are outlined below.

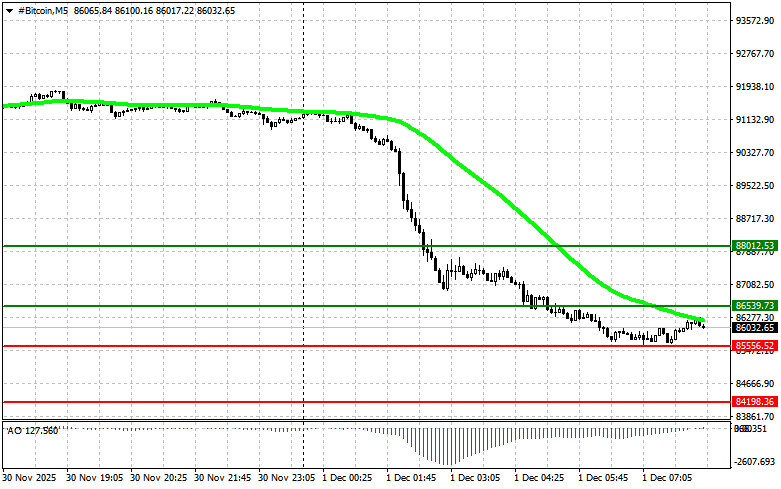

Bitcoin

Buy Scenario

Scenario 1: I plan to buy Bitcoin today upon reaching an entry point around $86,500, with a target price of $88,000. At around $88,000, I will exit the buys and sell immediately on the rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price and that the Awesome Indicator is above zero.

Scenario 2: I can buy Bitcoin from the lower boundary of $85,500 in the absence of market reaction to its breakout in the opposite direction toward levels of $86,500 and $88,000.

Sell Scenario

Scenario 1: I plan to sell Bitcoin today upon reaching an entry point around $85,500, with a target decline to $84,200. At around $84,200, I will exit the sales and buy immediately on the rebound. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome Indicator is below zero.

Scenario 2: I can sell Bitcoin from the upper boundary of $86,500 in the absence of market reaction to its breakout in the opposite direction toward levels of $85,500 and $84,200.

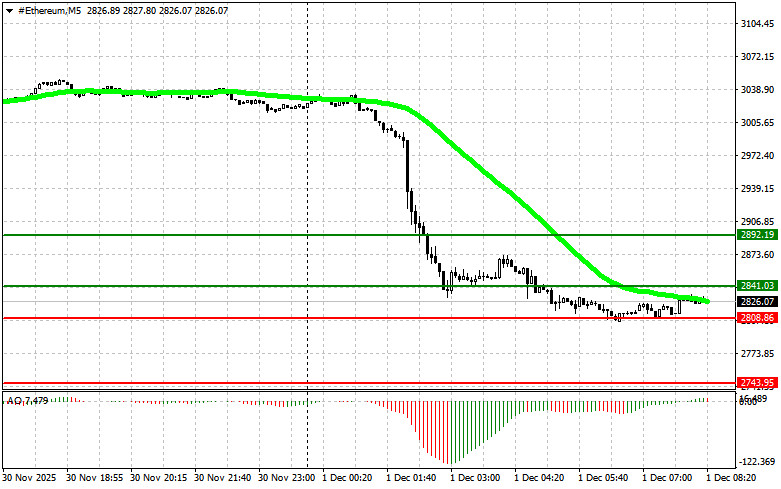

Ethereum

Buy Scenario

Scenario 1: I plan to buy Ethereum today upon reaching an entry point around $2,841, with a target price of $2,892. At around $2,892, I will exit the buys and sell immediately on the rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price and that the Awesome Indicator is above zero.

Scenario 2: I can buy Ethereum from the lower boundary of $2,808 in the absence of market reaction to its breakout in the opposite direction toward levels of $2,841 and $2,892.

Sell Scenario

Scenario 1: I plan to sell Ethereum today upon reaching an entry point around $2,808, with a target decline to $2,743. At around $2,743, I will exit the sales and buy immediately on the rebound. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome Indicator is below zero.

Scenario 2: I can sell Ethereum from the upper boundary of $2,841 in the absence of market reaction to its breakout in the opposite direction toward levels of $2,808 and $2,743.

Смотрите также