Bitcoin plummets to $85,000

Crypto-currencies

2025-12-01 07:22:34

With the onset of the new month, Bitcoin has dropped over 6% within just a few hours, reaching a new level of $85,500. This indicates that the market correction may have concluded, and we are likely to see new local lows with significant support being tested in the $75,000 and $70,000 ranges.

As Bitcoin and other altcoins "roll into the abyss," the market are actively speculating on the pace of tokenized assets. According to the head of the cryptocurrency department at the exchange, the American stock exchange Nasdaq considers the SEC's approval of its proposal for tokenized versions of listed stocks a top priority. "We will move as quickly as we can," said Matt Savarese, head of Nasdaq's digital asset strategy. "I think we need to carefully review public comments and then respond to any questions from the SEC as they arise," he added. "We hope to start working with them as soon as possible," Savarese concluded.

Tokenization of assets, whether stocks, bonds, real estate, or art, opens new horizons for investors and issuers. By breaking down expensive assets into smaller, accessible digital tokens, tokenization lowers the entry barrier for retail investors, allowing them to engage in markets that were previously inaccessible. Furthermore, tokenization can significantly enhance the liquidity of assets, making the buying and selling process easier on decentralized exchanges and platforms.

However, like any new technology, tokenization comes with certain risks and challenges. Regulatory uncertainty remains one of the main obstacles to the widespread adoption of tokenized assets. Different jurisdictions adopt different approaches to regulating tokens, creating complexities for companies seeking to offer tokenized assets internationally.

The proposal submitted by Nasdaq on September 8 includes a request to allow investors to buy and sell exchange tokens—digital representations of public companies' stocks. It's worth noting that back in October, Robinhood CEO Vlad Tenev stated that tokenization will ultimately engulf the entire financial system. On September 3, Galaxy Digital CEO Mike Novogratz also noted that his company became the first registered on Nasdaq to tokenize its capital on a major blockchain following its launch on the Solana network.

Currently, the Solana blockchain dominates the market for the offering and trading of tokenized stocks, holding more than a 95% market share for the past four months. In October this year, that share reached as high as 99%.

Trading recommendations

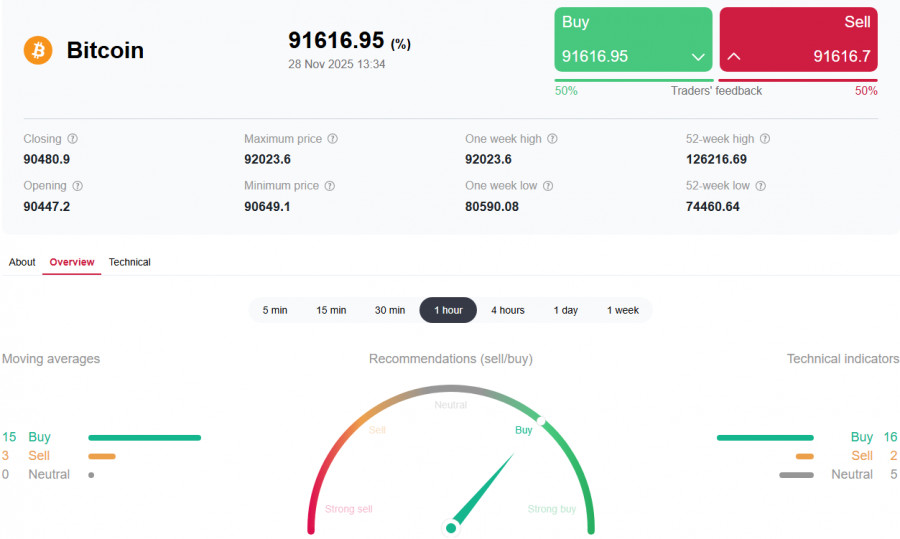

Regarding the technical picture of Bitcoin, buyers are now targeting a return to $86,500, which opens a direct path to $89,200, and from there it is just a short distance to $92,000. The furthest target will be a peak around $95,500; breaching this level would indicate attempts to return to a bull market. In case of a Bitcoin decline, I expect buyers at $83,900. A return of the trading instrument below this area could quickly drop BTC to around $81,200. The furthest target will be the area of $78,290.

As for the technical picture of Ethereum, a clear consolidation above $2,845 opens a direct path to $2,947. The furthest target will be the peak around $3,068; overcoming this level would signal a strengthening of bullish market sentiment and renewed interest from buyers. If Ethereum declines, I expect buyers at $2,732. A return of the trading instrument below this area could quickly drop ETH to around $2,626. The furthest target will be the area of $2,524.

What's on the chart

- Red lines represent support and resistance levels, where price is expected to either pause or react sharply.

- The green line shows the 50-day moving average.

- The blue line is the 100-day moving average.

- The lime line is the 200-day moving average.

Price testing or crossing any of these moving averages often either halts movement or injects fresh momentum into the market.

Смотрите также