Trading Recommendations for the Cryptocurrency Market on February 11

Crypto-currencies

2026-02-11 06:29:57

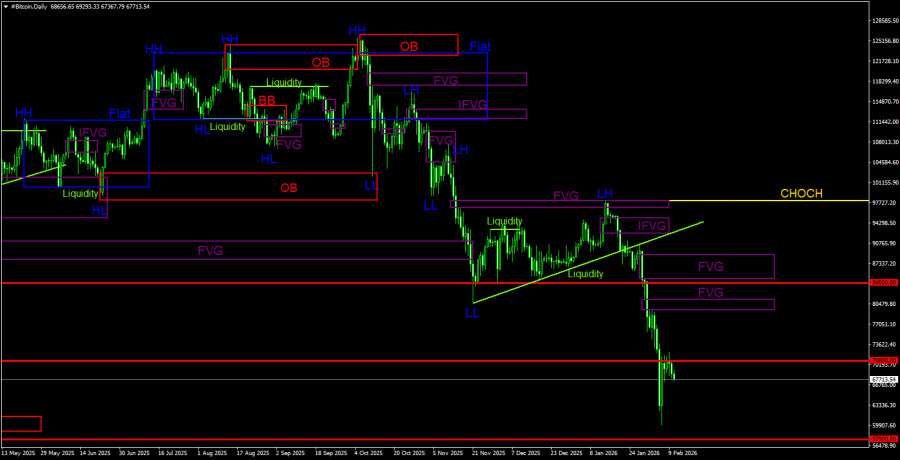

Nervousness and panic among traders persist. Bitcoin has returned to $67,000, while Ethereum has fallen below $2,000, indicating continued selling pressure.

According to the data, the primary sales are currently coming from the US. Yesterday, BlackRock transferred another 3,402 BTC ($234 million) and 30,216 ETH ($60.8 million) to Coinbase Prime for sale. In addition to large players like BlackRock, there is also a capital outflow from smaller investors. The price decline we are witnessing is prompting a flight to quality, as traders sell riskier assets in favor of more stable ones. This adds further pressure to the cryptocurrency market, which is already in a state of uncertainty.

The lack of new capital inflows exacerbates the situation. Institutional investors, who were previously the driving force behind growth, are now exercising caution. They may be waiting for clearer signals from regulators or for the macroeconomic situation to stabilize. Without fresh capital inflows, the market is forced to balance on the volumes already present, which automatically leads to declining prices when sellers are present.

It is important to note that the current situation indicates the continuation of a bearish trend; however, it is essential to understand that the cryptocurrency market is characterized by high volatility, and sharp reversals are not uncommon. Nevertheless, until a steady price recovery and new capital inflows are demonstrated, traders should exercise maximum caution and be prepared for further fluctuations.

Regarding the intraday strategy in the cryptocurrency market, I will continue to rely on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of a long-term bullish market that has not gone away.

As for short-term trading, the strategy and conditions are described below.

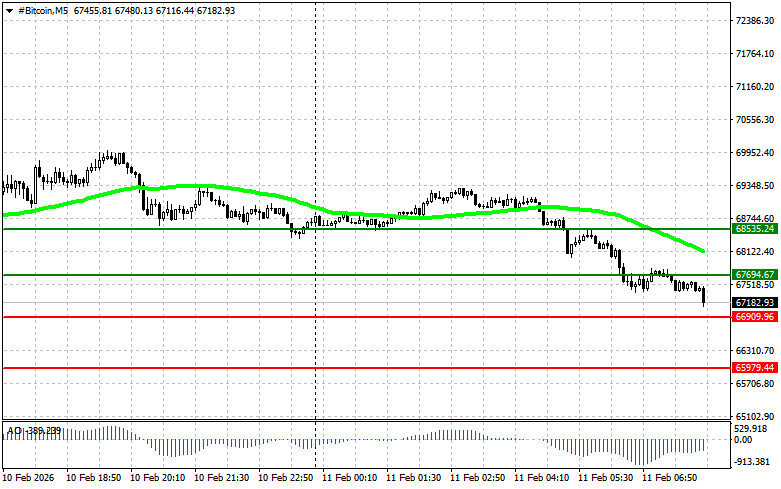

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $67,700, targeting a move to $68,500. Near $68,500, I will exit my buys and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: Bitcoin can be bought from the lower boundary of $66,900 if there is no market reaction to its breakout in the opposite direction back to levels of $67,700 and $68,500.

Sell Scenario

- Scenario #1: I will sell Bitcoin today upon reaching the entry point around $66,900, targeting a decline to $65,900. Near $65,900, I will exit my sales and buy on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: Bitcoin can be sold from the upper boundary of $67,900 if there is no market reaction to its breakout in the opposite direction back to levels of $66,900 and $65,900.

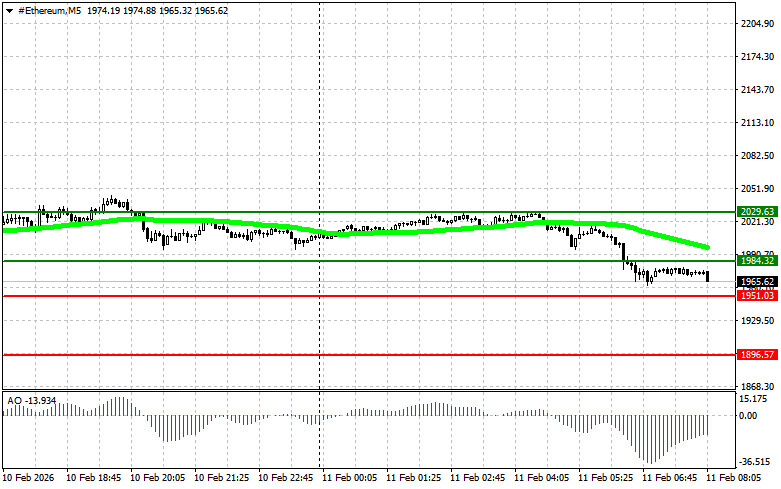

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $1,984, targeting a move to $2,029. Near $2,029, I will exit my buys and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: Ethereum can be bought from the lower boundary of $1,951 if there is no market reaction to its breakout in the opposite direction back to levels of $1,984 and $2,029.

Sell Scenario

- Scenario #1: I will sell Ethereum today upon reaching the entry point around $1,951, targeting a decline to $1,896. Near $1,896, I will exit my sales and buy on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: Ethereum can be sold from the upper boundary of $1,984 if there is no market reaction to its breakout in the opposite direction back to levels of $1,951 and $1,896.

Смотрите также