Problems in cryptocurrency market persist

Crypto-currencies

2026-02-11 06:45:34

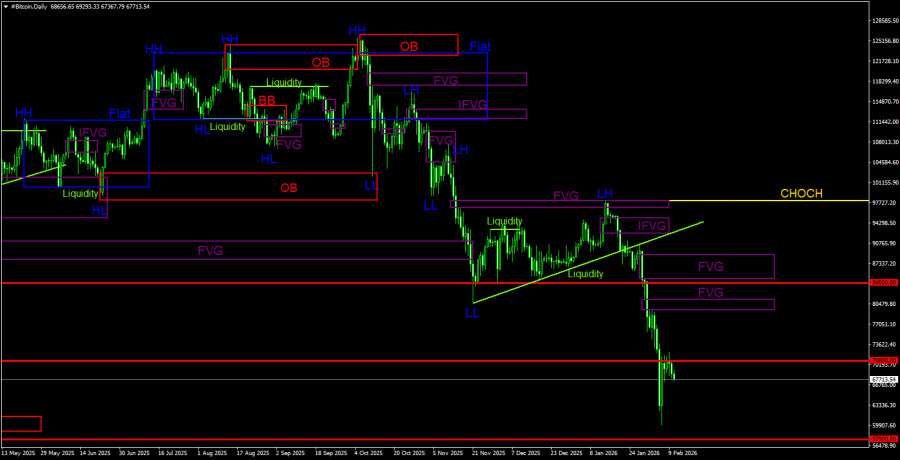

Bitcoin remains under pressure and it is trading around $67,000.

Events of recent weeks indicate the crypto market is entering a new phase of a decline, one devoid of the prior heedless euphoria. Remarks by Federal Reserve Governor Christopher Waller highlighted that transition and confirmed many observers' view that the recent rally, fueled by expectations of political change, was short-lived. The fall in key assets such as Bitcoin to multi-month lows is a clear sign that investors are rethinking strategies and favoring a more cautious approach.

Legislative uncertainty surrounding the CLARITY bill remains a significant barrier to further growth and institutionalization of the crypto market. Despite the bill's passage in the House of Representatives, its stall in the Senate and continuing disputes between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) underscore the complexity of the regulatory questions. The absence of clear rules, particularly on stablecoins and ethical standards, creates a climate of uncertainty that does not support long-term investment.

Despite these regulatory challenges, the Federal Reserve is actively working to build the infrastructure needed to integrate digital assets. The planned rollout of simplified master accounts ("skinny master accounts") for crypto and fintech firms by year-end is an important step in that direction. Those accounts, which will exclude interest income and emergency lending but will provide limited access to the US payments system, are intended to give market participants more stable operating conditions and could be a positive development for the crypto market.

Providing such accounts, even with restrictions, could help legalize and expand crypto firms' businesses by enabling more confident interaction with the traditional financial system. That, in turn, could boost trust and transparency in the sector, which is essential for sustainable development.

It is clear that the crypto market is undergoing a period of transformation in which short-term speculative sentiment is giving way to fundamental factors and the evolution of regulation.

Trading recommendations:

From a technical perspective, BTC buyers are targeting a return to $68,900, which would open a direct path to $72,100 and then $74,600. The extended target is the peak near $77,300. A breakout of that level would indicate attempts to restore a bullish market. On the downside, buyers are expected at $64,300. A fall below that area could quickly push BTC toward $60,100, with a further downside target near $56,300.

As for Ethereum, a clear consolidation above $2,095 would open a route to $2,199. The extended target is the peak near $2,316. Breaching that level would strengthen bullish sentiment and renew buyer interest. If ETH falls, buyers are anticipated at $1,972. A move below that zone could rapidly send ETH down to about $1,827, with a farther downside target near $1,720.

What we see on the chart:

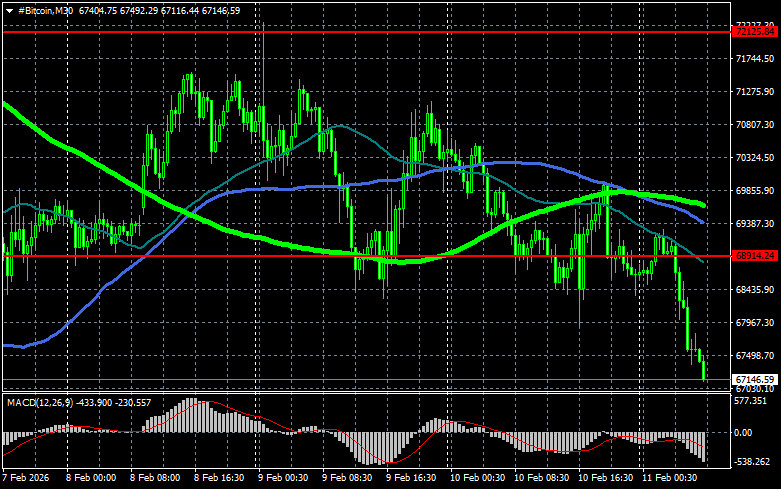

- Red lines indicate support and resistance levels where either a price slowdown or active growth is expected;

- Green lines indicate the 50-day moving average;

- Blue lines indicate the 100-day moving average;

- Light green lines indicate the 200-day moving average.

A crossover, or a price test of moving averages, typically either halts the move or sparks fresh market momentum.

Смотрите также